Exhibit 2.3

Delaware The First State I, JEFFREY W. BULLOCK, SEQRETARY OF STAIE OF THE STATE OF DELAWARE, DO HEREBY %'RTIFY THE ATTACHED IS A IRUE AND CORRECT COPY OF THE CERTIFICATE OF DESIGNATION OF “ALZAMEND NEURO, INC. ”, FILED IN THIS OETIE ON THE SECOND DAY OF AUGUST, A.D. 2016, AT 6:55 O‘CLOCK P.M. A FILED COPY OF THIS (IIRTIFICAIE HAS BEEN FORWARDED TO THE NEW CASTLE COUNTY RECORDER OF DEEDS. 995% '9 W /»'¥=>\1 /I ‘ Juflru W- l\0l4u:l_ Bcemwvy 04 sun 0 .. 5 .. 1 W i 1 -‘#1 5976073 8100 _/ Authentication: 202765465 SR# 20165196633 ‘7iL‘§>’ Date: O8-O3-16 You may verify this certificate online at corp.de|aware.gov/authver.shtm|

Slate oi Delaware Secretary of State Dlvlslon at‘ Corporations Delivered 06:55 P;‘\l 080242016 FILED 06:55 PM W02/2016 CERTIFICATE OF DESIGNATION SR 20165196633 - I-'lleNumlm' 5976073 OF ALZAMEND NEURO, INC-. Pursuant to Section-15¢l(g) ofthe Delaware General Corporation Law SERIES A CON VERTIBLE PREFERRED STOCK " ' ‘On behalf ofAlznmend Neuro,-‘lnc., a Delaware corporation (thc “Co;rQration”), the undersigned hereby certifies that the following resolution has been duly adopted by the board of directors of the Corporation (the “§o§_r_r1”): RESOLVED, that, pursuant to the authority granted to and vested in thc'Board by the provisions of the articles of incorporation of the Corporation (the “Articles of lncorgqration”), there hereby is ereated, out of ‘the ten million 00,000,000) shares of preferred stock, par value 36.0001 per share, of the Corporation-authorized by Article Fourth of the Arrietes'of’Ineor'poration (“Preferred Stoc-k”),‘Series A Convertibles-Preferred Stockreonsisting of one million three ‘hundred '-sixty thousand (£360,000) shares, which series shall "have the ‘following powers, designations; preferences and, relétive participating, optional and other special rights, and the following qualifications, lirnitations and restrictions: The specific powers, preferences, rights and limitations of the Series A Convertible Preferred Stockareasfollows: ' ‘ ’ " ' " " ' " " ’ 1. Designation Rank. This series of Preferred Stock shall be designated and known as “Series A"-Convertible Preferred Stock.” The nwnbcr of shares constituting the Series A Convertible Preferred Stock shall be one million three hundred sixty thousand (1,360,000) shares. Except as otherwise provided herein, the Series A Convertible Preferred Stock shall, with respect to rights on liquidation, winding up and dissolution; rank pari passu with the common stock, par value $0.000] per share (the “Common Stock”), of the Corporation. " ' 2. "Dividends. The Holders of shares of the Series A Convertible Preferred Stock ‘shall have no dividend rights -except as may be declared by the Board in its sole and absolute discretion, out of funds legally nvallablefor that purpose. 3. Liquidation. (a) ln the event of any dissolution, liquidation or winding up of the Corporation (a “Liguidation”), whether voluntary or involuntary, the Holders of Series A Convertible Preferred Stock shall be entitled -to participate in any distribution ‘out of the assets of the Corporation on an equal basis per share with the holders of the Common Stodk. l

(b) A sale of all or substantially all of the Corporation’s assets or an acquisition of the Corporation by another entity by means of any transaction or series of related transactions (including, without limitation, a reorganization, consolidated or merger) that results in the transfer of fifty percent (50%) or more of the ‘outstanding voting power of the Corporation (a “Change in Control Event”), shall not be deemed to be a Liquidation for purposes of this Designation. 4. Conversion of Series A Convertible Preferred Stock. The Holders of Series A Convertible Preferred Stock shall have conversion rights as follows: (a) Conversion Right. Each share of Series A Convertible Preferred Stock shall be convertible at the option of the Holder thereof and without the payment of additional consideration by the Holder thereof, at any time, into shares of Common Stock on the Optional Conversion Date (as hereinafter" defined) at a conversion rate of eighty (80)-shares. of Common Stock (the “Conversion Rate") for every one (1) share of Series A Convertible Preferred Stock. » (b) Mechanics of Optional Conversion. To effect the optional conversion of shares of Series A Convertib_le.Prefen'ed¢Sto_ck in accordance with Section 4(a) of this Designation, any Holder’ of record shall make a written -demand for such conversion (for purposes of this Designation, a “Conversion Demand") upon the Corporation at its principal executive ivotlices setting -forth therein (i) the certificate or certificates representing - such shares, and (ii) the proposed date. of such conversion, whichshall be a business day not less than ten (10) nor more than thirty (30) days after the date of such ‘Conversion Demand (for purposes ofthis Designation, the “Optional Conversion Date“). Within five days of receipt of the Conversion Demand, the Corporation shall give written notice (for purposes-ofthis.Dcsignation, a “Convegigg Notice”) to the Holder setting forth therein (i) the address of the place or places at which the -certificate or certificates representing any shares not yet tendered are to be converted are to be surrendered; and (ii) whether the certificate or certificates to be surrendered are required to be endorsed tor transfer or accompanied by a duly executed stock power or other appropriate instnimcnt ofrassignmcnt and, if so, the form of such endorsement or power or other "instrument of assignment. "The Conversion Notice shall be sent by first class mail, postage prepaid, to such Holder at such Holder’s address as may be set forth in the Conversion Demand or, if not set forth therein, as it appears on the records of the stock transfer agent for the Series A Convertible Preferred Stock, if any, or, if none, of the Corporation. Go or before the Optional Conversion Date, each Holder of‘ the Series-A Convertible Preferred Stock so- to be converted shall surrender the certificate or certificates representing such ‘shares, duly endorsed for "transfer or accompanied by‘ a duly executed stock power or other instrument of assignment, if the Conversion Notice so provides, to the Corporation at any place set forth in such notice or, if no such place is so set forth, at the principal executive offices of the Corporation. As soon as practicable otter the Optional Conversion Date and the surrender of the certificate or certificates representing such shares, the Corporation shall issue and deliver to such Holder, or its nominee, at such I_iolder’s address as it appears on the records of the stock transfer agent for the Series A Convertible Preferred Stock, if any, or, if none, of the Corporation, a certificate or certificates for the number of whole shares of Common Stock issuable upon such conversion in accordance with the provisions hereof. (c) No Fractional Shares. No fractional shares of Common Stock or scrip shall be issued upon conversion of shares of Series A Convertible Preferred Stock. ht lieu of any fractional share to which the Holder would be entitled but for theprovisions of this Section 4(c) 2

bus-ed on the number of shares of Series A Convertible Preferred Stock held by such I-lolder, the Corporation shall issue a number of shares to such Holder rounded up to the nearest whole number of shares ot'Comn-ion Stock. No cash shall be paid to any Holder of Series A Conveltiblc Preferred Stock by the Corporation upon conversion of Series A Preferred Convertible Stock by such Holder. - (d) §_§er\'ati0n of Stock. The Corporation shall at all times when any shares of Series A l-’rel’en'ed Convertible Stock shall be outstanding, reserve and keep available out of its p authorizecl but unissued Common Stock, such number of shares of Common Stock as shall from time to time he sufilcient to effect the conversion of all outstanding shares of Series A Conve-ltible Prefened Stock. if at any time the number of authorized but unissued shares of Common Stock shall not be sufficic-nt to effect the conversion of all outstanding shares of the Series A Convertible Preferred Stock, the Corporation will take such corporate action as may, in the opinion ofits counsel, be necessary to increase its authorized but unissued shares ofCommon Stock to such nutnber ofshares as shall he sufficient for such purpose. (e) lg ue Tggges. The convelting Holder shall pay any and all issue and other non- incomc taxes that may be payable it respect ofany issue or delivery ofsltares ol'Cornmon Stock on conversion of shares of Series A Conveltiblc Preli~>'rred Stock. 5. Voting; The holders ofScrte.<: A Conveltible Preferred Stock shall have the right lo cast two hundred (200) votes for each share held of record on all matters submitted to a vote of holders of the Corporations common stock, including the election ofdircctors, and all other matters as required by law. There is no right to cumulative voting in the election of directors; The holclcts of Series A Convertible Preferred Stock shall votc together with all other classes and series of common stock oflhe Corporation as a single class on all actions no be taken by the common stock holders ofthe Corporation 6XCCpl to the extent that voting as a separate class or series is required by law. N WITNESS WHEREOF, the undersigned have duly signed this Designation as ot‘~this 30th day nib/lay, 2016. _ Alzamend Neuro, inc. ~* _ ___:;“*~ ~~~~~~~~ ...~___ By: (:~l?lri§i’p"t>'_“Mm1sotzr “ ‘ ~ Title: Pn:sidenlantiCP.O 3

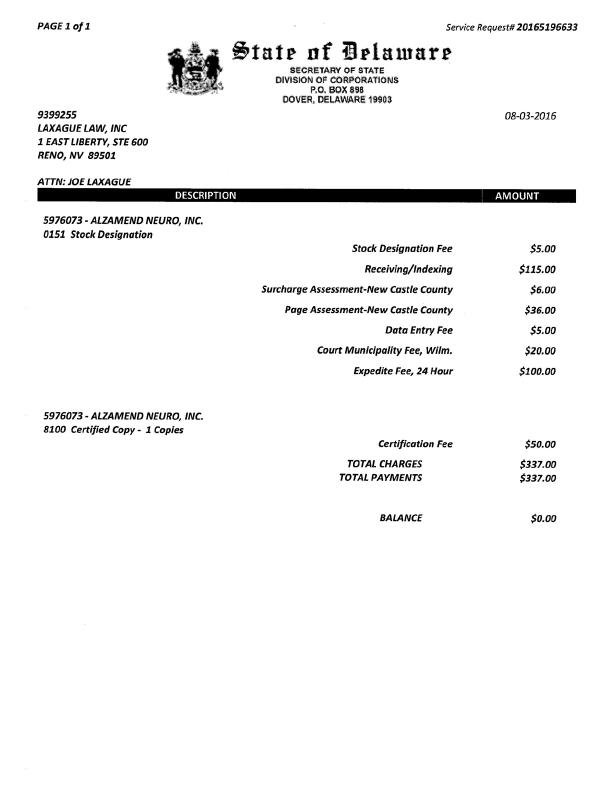

PAGE 1 of 1 Sen/ice Requestfi 20165196633 42- £11012 nf Erlamare SECRETARY OF STATE DIVISION OF CORPORATKBNS 1. _ ,."‘1 P.O. BOX ass 9399255 08-03-2016 LAXAGUE LAW, INC 1 EASTLIBERTY, STE 600 RENO, NV 89501 ATTN: JOE LAXAGUE 5976073 - ALZAMEND NEURO, INC. 0151 Stock Designation 5976073 - ALZAMEND NEURO, INC. 8100 Certified Copy- 1 Copies DOVER. DELAWARE 19903 Stock Designation Fee Receiving/Indexing Surcharge Assessment-New Castle County Page Assessment-New Castle County Data Entry Fee Court Municipality Fee, Wilm. Expedite Fee, 24 Hour Certification Fee TOTAL CHARGES TOTAL PAYMENTS BALANCE $5.00 $115.00 $6.00 $36.00 $5.00 $20.00 $100.00 $50.00 $337.00 $337.00 $0.00