UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended: April 30, 2020

ALZAMEND NEURO, INC.

(Exact name of issuer as specified in its charter)

|

Delaware |

2834 |

81-1822909 | ||

| State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer Identification No.) | ||

| incorporation or organization | Classification Code Number) |

| 3802 Spectrum Boulevard, Suite 112C |

| Tampa, Florida 33612 |

| (Full mailing address of principal executive offices) |

| (844) 722-6333 |

| (Issuer’s telephone number, including area code) |

Common Stock

(Title of each class of securities issued pursuant to Regulation A)

Corporation Service Company

2711 Centerville Road, Suite 400

Wilmington, Delaware 19808

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Henry Nisser, Esq.

Alzamend Neuro, Inc.

100 Park Avenue, Suite 1658

New York, New York 10017

Telephone: (844) 722-6333

ALZAMEND NEURO, INC.

TABLE OF CONTENTS

| Page | ||

| PART II | ||

| Statements Regarding Forward-Looking Information | 2 | |

| Item 1. | Description of Business | 2 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 41 |

| Item 3. | Directors, Executive Officers and Corporate Governance | 47 |

| Item 4. | Security Ownership of Management and Certain Securityholders | 52 |

| Item 5. | Interest of Management and Others in Certain Transactions | 53 |

| Item 6. | Other Information | 55 |

| Item 7. | Financial Statements | 55 |

| Item 8. | Exhibits | 56 |

| Index to Financial Statements of Alzamend Neuro, Inc. | F-1 |

| 1 |

Part II.

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 1-K contains forward-looking statements. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Such forward-looking statements include statements regarding, among others, (a) our expectations about possible business combinations, (b) our growth strategies, (c) our future financing plans, and (d) our anticipated needs for working capital. Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “approximate,” “estimate,” “believe,” “intend,” “plan,” “budget,” “could,” “forecast,” “might,” “predict,” “shall” or “project,” or the negative of these words or other variations on these words or comparable terminology. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found in this Annual Report.

Forward-looking statements are based on our current expectations and assumptions regarding our business, potential target businesses, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements as a result of various factors, including, without limitation, changes in local, regional, national or global political, economic, business, competitive, market (supply and demand) and regulatory conditions and the following:

| · | Our ability to effectively execute our business plan; |

| · | Our ability to manage our expansion, growth and operating expenses; |

| · | Our ability to evaluate and measure our business, prospects and performance metrics; |

| · | Our ability to compete and succeed in a highly competitive and evolving industry; |

| · | Our ability to respond and adapt to changes in technology and customer behavior; and |

| · | Our ability to protect our intellectual property and to develop, maintain and enhance a strong brand. |

We caution you therefore that you should not rely on any of these forward-looking statements as statements of historical fact or as guarantees or assurances of future performance. All forward-looking statements speak only as of the date of this Annual Report. We undertake no obligation to update any forward-looking statements or other information contained herein.

Information regarding market and industry statistics contained in this Annual Report is included based on information available to us that we believe is accurate. It is generally based on academic and other publications that are not produced for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. Except as required by U.S. federal securities laws, we have no obligation to update forward-looking information to reflect actual results or changes in assumptions or other factors that could affect those statements.

| ITEM 1. | DESCRIPTION OF BUSINESS |

In this Annual Report, unless the context requires otherwise, references to the “Company,” “Alzamend,” “we,” “our company” and “us” refer to Alzamend Neuro, Inc., a Delaware corporation.

Company Overview and Description of Business

The Company

We were formed on February 26, 2016, as Alzamend Neuro, Inc. under the laws of the State of Delaware. We were formed to acquire and commercialize patented intellectual property and know how to prevent, treat and cure the crippling and deadly Alzheimer’s disease (“Alzheimer’s” or “AD”). We have developed a unique approach for combating Alzheimer’s, namely through immunotherapy. Current drugs approved by the FDA for Alzheimer’s only address symptoms and provide no benefit to the impaired immune system caused by Alzheimer’s.

| 2 |

On May 29, 2018, we implemented a 1-for-4 Reverse Stock Split of our Common Stock. The Reverse Stock Split became effective on December 13, 2018. As a result of the Reverse Stock Split, every four (4) shares of our pre-Reverse Stock Split Common Stock were combined and reclassified into one share of the Common Stock. The number of shares of Common Stock subject to outstanding options and warrants were also reduced by a factor of four as of December 13, 2018 and their respective exercise prices were increased by a factor of four. All historical share and per-share amounts reflected throughout the consolidated financial statements and other financial information in this Annual Report have been adjusted to reflect the Reverse Stock Split. Neither the authorized shares of capital stock nor the par value per share of the Common Stock was affected by the Reverse Stock Split.

Alzamend is a company focused on the facilitation of bringing technologies to market which help with the treatment, prevention or cure of Alzheimer’s.

On May 1, 2016, we obtained a royalty-bearing, exclusive worldwide license from the University of South Florida Research Foundation, Inc. (the “Licensor”), to a mutant-peptide immunotherapy that is designed to be used as a vaccine or prophylactic against Alzheimer’s. This treatment, known as AL002 (formerly known as CAO22W), has transitioned from early stage development to an extensive program of preclinical study and evaluation with an anticipated completion date in the fourth quarter of calendar year 2020. AL002 will require extensive clinical evaluation, regulatory review and approval, significant marketing efforts and substantial investment before it can provide us with any revenue. We plan to file an Investigational New Drug (“IND”) application with the United States Food and Drug Administration (the “FDA”) with respect to AL002 in the fourth quarter of calendar year 2020 and prepare to conduct a Phase 1 Clinical Trial in the fourth quarter of calendar year 2020.

On July 2, 2018, we obtained two royalty-bearing, exclusive worldwide licenses from the Licensor to a therapy known as AL001 (formerly known as LiProSal) to mitigate extreme agitation and forestall other deterioration as displayed by patients with mild to moderate AD. AL001 is an ionic cocrystal of lithium and has been shown to exhibit improved nonclinical pharmacokinetics compared to current FDA-approved lithium products; it is also bioactive in many in vitro models of Alzheimer’s. AL001 is expected to provide clinicians with a major improvement over current lithium-based treatments and may also constitute a means of treating Alzheimer’s and other neurodegenerative diseases. Based on nonclinical data, AL001 co-crystal technology has the potential to improve the therapeutic index of lithium providing a greater bioavailability to the site of action (brain) in comparison to more traditional lithium dosage forms. Lithium has been marketed for over 35 years and human toxicology regarding lithium use has been well characterized, mitigating the potential regulatory burden for safety data. We submitted a pre-IND briefing package to the FDA in July 2019 that argued against the need for any further preclinical safety studies. Per the FDA response letter, we believe the proposed test parameters for AL001 appears reasonable to support a Phase 1 study, thereby allowing us to conduct human clinical trials. Post Phase III clinical trials and in order to obtain approval to commercialize AL001 via a New Drug Application (“NDA”), Alzamend has been asked to provide a scientific bridge to a listed drug to support the adequacy of the nonclinical program. Per the FDA, the adequacy of the nonclinical data will be a matter of review. If the adequacy of the nonclinical data is not sufficient for the FDA, Alzamend will then be required to conduct a clinical pharmacokinetics animal study (6-weeks study) of AL001 in order to be considered for FDA approval. We received feedback from the FDA regarding the pre-IND briefing package and have begun the process of finalizing the IND application and, while FDA approval is not guaranteed, we expect to receive approval to begin a Phase 1 Clinical Trial with human subjects in the fourth quarter calendar year 2020. While the FDA has not given us any indication as to whether AL001 will receive Breakthrough Therapy designation or be permitted to use the 505(b)(2) regulatory pathway, we believe that AL001 is an ideal candidate to receive both a Breakthrough Therapy designation as well as a section 505(b)(2) regulatory pathway for new drug approvals, enhancing the speed and reducing the regulatory burden of FDA review.

Technology

AL001

The patented solution that we have licensed and will first move to commercialization is an ionic cocrystal of lithium for the treatment of Alzheimer’s and a method of preparation for other pharmaceutical and industrial purposes. Lithium salts have a long history of human consumption beginning in the 1800’s. In psychiatry, they have been used to treat mania and as a prophylactic for depression since the mid-20th century. Today, lithium salts are used as a mood stabilizer for the treatment of bipolar disorder. Although the FDA has approved no medications as safe and effective treatments for suicidality, lithium has proven to be the only drug that consistently reduces suicidality in patients with neuropsychiatric disorders. Despite these effective medicinal uses, current FDA-approved lithium pharmaceutics (lithium carbonate and lithium citrate) are limited by a narrow therapeutic window that requires regular blood monitoring of plasma lithium levels and blood chemistry by a clinician to mitigate adverse events. Because conventional lithium salts (carbonate and citrate) are eliminated relatively quickly, multiple administrations throughout the day are required to safely reach therapeutic plasma concentrations. However, existing lithium drugs such as lithium chloride and lithium carbonate suffer from chronic toxicity, poor physicochemical properties and poor brain bioavailability. Because lithium is so effective as a mood stabilizer in treating patients with bipolar disorder, it is still used clinically despite its narrow therapeutic index. This has led researchers to begin to look for alternatives to lithium with similar bioactivities.

| 3 |

The inventors from the University of South Florida (the “University”) have developed a new lithium cocrystal composition and method of preparation that allow for lower dosages to achieve therapeutic brain levels of lithium for psychiatric disorders, broadening lithium’s therapeutic index. The compound offers improved physiochemical properties compared to existing forms of lithium, giving it the potential to be developed as an anti-suicidal drug or for use against mood disorders. The formulation method may also be used for commercial/industrial applications such as green chemistry, engineering low density porous materials, pesticides/herbicides, explosives/propellants, and electronic materials.

Recent evidence suggests that lithium may be efficacious for both the treatment and prevention of Alzheimer’s. Unlike traditional medications which only address a single therapeutic target, lithium appears to be neuroprotective through several modes of action. For example, it exerts neuroprotective effects, in part, by increasing a brain-derived neurotrophic factor leading to restoration of learning and memory. Another neuroprotective mechanism of lithium is attenuation of the production of inflammatory cytokines like IL-6 and nitric oxide in activated microglia. Moreover, results from recent clinical studies suggest that lithium treatment may reduce dementia development while preserving cognitive function and reducing biomarkers associated with AD.

With this in mind, the team of inventors from the University have specifically designed, synthesized and characterized the novel ionic cocrystal of lithium (known as AL001). AL001 has been shown to exhibit improved nonclinical pharmacokinetics compared to current FDA-approved lithium products; it is also bioactive in many in vitro models of Alzheimer’s. AL001 is expected to provide clinicians with a major improvement over current lithium-based treatments and may also constitute a means of treating Alzheimer’s and other neurodegenerative diseases and psychiatric disorders.

A product can be designated as a Breakthrough Therapy if it is intended to treat a serious condition and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over available therapy on a clinically significant endpoint(s). A drug that receives a Breakthrough Therapy designation is eligible for fast track designation features, intensive guidance on an efficient drug development program and FDA organizational commitment involving senior managers. We believe that AL001 is ideally positioned for a Section 505(b)(2) regulatory pathway for new drug approvals. The Section 505(b)(2) regulatory pathway provides manufacturers with an opportunity to obtain FDA approval without performing all the work that’s required by an NDA. Those drugs that qualify for the 505(b)(2) regulatory pathway are an option for drugs with a new aspect related to indication, dosage form or regimen, strength, combination with other products, or other unique traits. If we receive approval through the 505(b)(2) regulatory pathway AL001 would be eligible for 3-5 years of market exclusivity during which period AL001 would be protected from competitors. If we successfully acquire a Breakthrough Therapy designation and the Section 505(b)(2) regulatory pathway for new drug approvals, we believe we can receive FDA approval for AL001 in four years.

AL001 will require extensive clinical evaluation, regulatory review and approval, significant marketing efforts and substantial investment before it or any successors could provide us with any revenue. As a result, if we do not successfully develop, achieve regulatory approval for and commercialize AL001, our long-term business plans will not be met, and we will be unable to generate the revenue we have forecast for many years, if any. We do not anticipate that we will generate our maximum revenue for several years, or that we will achieve profitability for this therapeutic until at least a few years after generating material revenue, if at all. If we are unable to generate revenue, we would not be able to pursue any expansion of our business or acquire additional intellectual property as we have planned, we will not become profitable with this therapeutic agent, and we would be unable to continue our operations as currently planned.

AL002

The other patented solution that we have licensed to move to commercialization is AL002, a mutant-peptide immunotherapy designed to be used as a vaccine or prophylactic against Alzheimer’s. This therapy is intended to work by stimulating the body’s own immune system to prevent the formation and breakdown of beta amyloids, which build up in the brain to form a “plaque,” and subsequently block the neurological brain signals that ultimately lead to the symptoms and onset of Alzheimer’s. Immunotherapy is the treatment of disease by inducing, enhancing, or suppressing an immune response. Immunotherapies that are designed to elicit or amplify an immune response are classified as activation immunotherapies, whereas immunotherapies that reduce or suppress an immune response are classified as suppression immunotherapies. We believe that strategies to strengthen the immune system in the elderly, who are most susceptible to the development of Alzheimer’s, could greatly enhance the effectiveness of immune-based approaches towards Alzheimer’s. Our novel immune-based methodology attempts to inhibit the natural process of immunological aging by restoring the balance of the immune system through immunomodulation.

| 4 |

Beta amyloid protein has been directly linked to Alzheimer’s and the associated neurofibrillary tangles formation seen in Alzheimer’s patients. Specifically, increased levels of extracellular plaques in the brain composed of amyloid beta peptide 1-42 are seen in Alzheimer’s patients when compared to healthy people. In a healthy brain, protein fragments such as amyloid beta peptide 1-42 are broken down and eliminated. However, in individuals with Alzheimer’s, the fragments accumulate to form hard, insoluble plaques. Attempts have been made to help inhibit plaque formation by reducing the amount of amyloid beta peptide 1-42 through vaccines that generate an immune response to the protein. The challenge has been that though effective in reducing the amount of the protein, the inflammatory response has been such that the intended benefits are not seen. These vaccines have used an adjuvant, or helper, to generate the necessary immune response and it is believed that this adjuvant triggers the unwanted surplus inflammation. We have licensed rights to a vaccine using autologous cells that does not require an adjuvant and therefore, we believe, will trigger the immune response, which should help eliminate the amyloid beta peptide 1-42 without generating the excess inflammation and therefore, have a positive clinical effect. We believe that the vaccine, in addition to dealing with plaque formation, also ameliorates the impaired immune system that is thought to be the major issue in Alzheimer’s patients.

Our data have demonstrated that these mutant-peptide sensitized dendritic cells (“DC”) can act as a vaccine to generate a durable antibody response, as well as enhance the number of CD8+ T-cells and increase the lifespan of CD8+ cells (T and DCs cells), compared to control subjects. These studies will provide a further rationale and impetus for using this novel vaccine to determine potential efficacy in human clinical trials against Alzheimer’s.

AL002 has been researched for more than ten years and we are currently in the midst of completing its preclinical development and have begun both the pre-IND and IND application process with the FDA, which is managed by TAMM Net, Inc., an experienced and highly-regarded regulatory consultancy firm. In November 2018, we began a toxicological preclinical study for AL002 with Charles River Laboratories, Inc. (“CRL”) in compliance with FDA requirements. Upon conclusion of this toxicological study, anticipated to occur at the end of November 2020, we expect to begin the process of finalizing the IND application process and move quickly forward to begin a Phase 1 Clinical Trial with human subjects. AL002 will require extensive clinical evaluation, regulatory review and approval, significant marketing efforts and substantial investment before it and any successors could provide us with any revenue. As a result, if we do not successfully develop, achieve regulatory approval for and commercialize AL002, our long-term business plans will not be met, and we will be unable to generate the revenue we have forecast for AL002 for many years, if any. We do not anticipate that we will generate our maximum revenue for several years, or that we will achieve profitability for this therapeutic until at least a few years after generating material revenue, if at all. If we are unable to generate revenue, we would not be able to pursue any expansion of our business or acquire additional intellectual property as we have planned, we will not become profitable with this therapeutic agent, and we would be unable to continue our operations as currently planned.

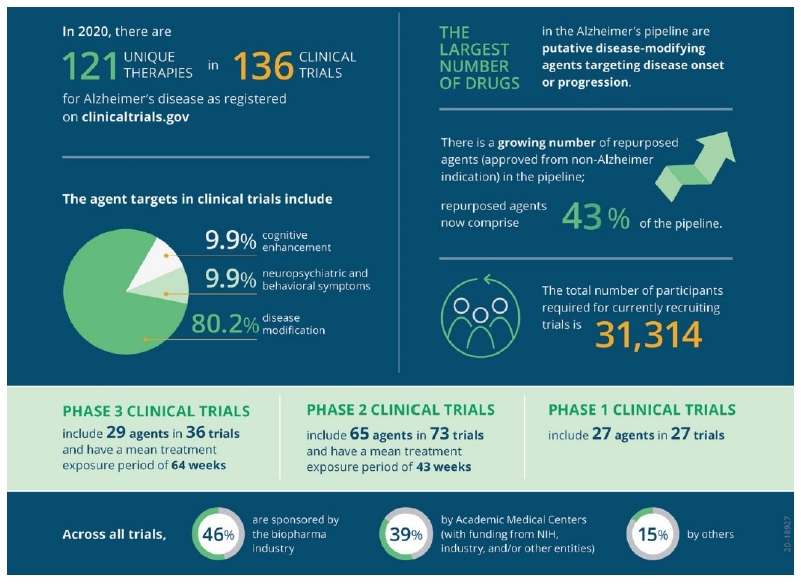

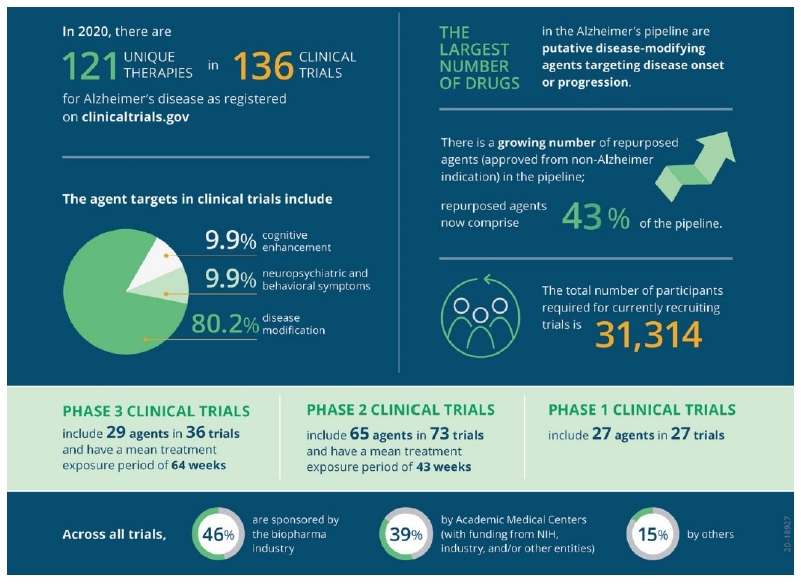

Market

Currently, Alzheimer’s is the 6th leading cause of death in the U.S. and when extrapolated globally, the market for preventions, treatments, and cures of this crippling disease is massive. The Alzheimer’s Association estimates that the cost of caring for people with Alzheimer’s and other dementias will reach $305 billion in 2020 and that by 2050, these costs may rise as high as $1.1 trillion. Since 1990, life expectancy has increased by six years and the worldwide average continues to increase. With the increase in the mean age of the population in developed countries, the prevalence of deteriorating neurological diseases has also increased. According to the Alzheimer’s Association, in the United States alone, one in 10 persons over the age of 65 have Alzheimer’s, with more than 5.8 million Americans living with it. It is estimated that this number will increase to more than 14 million by 2050 if a vaccine, therapeutic or cure is not found. Many Alzheimer’s related associations believe the actual number of adults with AD may be as much as five times more, or 30 million, since current statistics do not take into account deaths from complications or from related diseases like pneumonia or heart attack. These death certificates only list the most immediate cause. The fastest growing age group in the United States is the “over 85” group within which one in three individuals have Alzheimer’s. Women are 2½ times more likely to die from Alzheimer’s than from cancer.

| 5 |

The rate of deaths related to Alzheimer’s increased by 54.5 percent over 15 years, according to a report issued on May 27, 2017, by the U.S. Centers for Disease Control and Prevention. There were 93,541 deaths related to Alzheimer’s in 2014, a rate of 25.4 deaths per 100,000 people, up from 44,536 deaths in 1999, a rate of 16.5 deaths per 100,000 people, according to the report. The disease currently affects an estimated 5.8 million people in the U.S., but that number is expected to rise dramatically in people over the age of 65 to 14 million in 2050. The researchers examined death certificate data from the National Vital Statistics System to reach their findings.

Every 65 seconds, someone in the United States develops AD. Of the 10 most fatal diseases in the United States, Alzheimer’s is the only one with no cure, no known way of deceleration and no known means of prevention approved by the FDA and available to the public. Alzamend was formed to commercialize patented intellectual property in this space, by funding it from its present state through human clinical trials administered by the FDA and ultimately, if successful, potentially make it available to the global market.

Business Plans

Our plan of operations is currently focused on the development of both our therapeutic candidates, which are at different stages in development. We have begun the process of finalizing the IND application for AL001 and expect to receive approval to begin a Phase 1 Clinical Trial with human subjects in the fourth quarter calendar year 2020.

We expect to begin the process of finalizing the IND application process for AL002 and move quickly forward to begin a Phase 1 Clinical Trial with human subjects during the second quarter of calendar year 2021.

We engaged Emory University, located in Atlanta, Georgia, to develop and plan the Phase 1 Clinical Trial protocols, processes and plan. Dr. Ihab Hajjar, Neurologist at the Emory Clinic, has been selected to be the Lead Investigator for this set of clinical activities. We have also retained a division of the international Swiss manufacturer, Lonza, to develop the manufacturing protocols, processes and procedures. Lonza is the worldwide leader in producing immunological proprietary and contracted pharma solutions. We anticipate selecting Emory University as the host for the Phase 1 Clinical Trial, which will be led by Dr. Hajjar at the Emory Clinic.

In November 2018, we adopted a Charter for our Scientific Advisory Board (“SAB”) and have announced the appointment of two SAB members, Dr. Thomas Wisniewski (Director of the NYU Pearl Barlow Center for Memory Evaluation and Treatment) and Dr. Eric McDade (Associate Director of the Dominantly Inherited Alzheimer Network Trials Unit (DIAN-TU)). The SAB members have clinical specializations, including extensive experience with AD and other neurological diseases. We intend to rely on these experts to help guide our therapies through the related scientific and manufacturing initiatives.

The continuation of our current plan of operations to completing our IND application and beginning the series of human clinical trials for each of our therapeutics requires us to promptly raise significant additional capital. If we are successful in raising capital, we believe that we will have sufficient cash resources to fund our operations.

Because our working capital requirements depend upon numerous factors, including the progress of our preclinical and clinical testing, timing and cost of obtaining regulatory approvals, changes in levels of resources that we devote to the development of manufacturing and marketing capabilities, competitive and technological advances, status of competitors, and our ability to establish collaborative arrangements with other organizations, we will require additional financing to fund future operations.

FDA consulting and active project planning management

We have retained TAMM Net, Inc., an experienced and highly-regarded regulatory consultancy firm based in Georgia for project management. In this capacity, TAMM Net will lead, develop and manage our preclinical and clinical efforts, extending from the current status of each product candidate through the exit or commercialization of the technologies that we have licensed. We may retain an experienced Canadian and European Union consulting firm to commercialize these same technologies for these geographic markets.

Funding new AD research and acquisition of licenses to treat or cure AD

We have committed to funding new research projects from Dr. Chuanhai Cao, the neuroscientist who developed AL002, and his medical team for at least the next three years.

| 6 |

We obtained two royalty-bearing, exclusive worldwide licenses from the Licensor for AL001, a cocrystal biologic therapy intended to mitigate extreme agitation and forestall further deterioration of memory as displayed by patients with mild to moderate AD effective as of July 2, 2018.

We are dedicated to acquiring and supporting new research to treat or cure AD and reserves the right to evaluate and pursue each opportunity as it may arise.

Our Product Candidates

AL001

The patented solution that we have licensed and will first move to commercialization is an ionic cocrystal of lithium for the treatment of Alzheimer’s and a method of preparation for other pharmaceutical and industrial purposes. Lithium salts have a long history of human consumption beginning in the 1800’s. In psychiatry, they have been used to treat mania and as a prophylactic for depression since the mid-20th century. Today, lithium salts are used as a mood stabilizer for the treatment of bipolar disorder. Although the FDA has approved no medications as safe and effective treatments for suicidality, lithium has proven to be the only drug that consistently reduces suicidality in patients with neuropsychiatric disorders. Despite these effective medicinal uses, current FDA-approved lithium pharmaceutics (lithium carbonate and lithium citrate) are limited by a narrow therapeutic window that requires regular blood monitoring of plasma lithium levels and blood chemistry by a clinician to mitigate adverse events. Because conventional lithium salts (carbonate and citrate) are eliminated relatively quickly, multiple administrations throughout the day are required to safely reach therapeutic plasma concentrations. However, existing lithium drugs such as lithium chloride and lithium carbonate suffer from chronic toxicity, poor physicochemical properties and poor brain bioavailability. Because lithium is so effective at reducing manic episodes in patients with bipolar disorder, it is still used clinically despite its narrow therapeutic index. This has led researchers to begin to look for alternatives to lithium with similar bioactivities.

The inventors from the University have developed a new lithium cocrystal composition and method of preparation that allow for lower dosages to achieve therapeutic brain levels of lithium for psychiatric disorders, broadening lithium’s therapeutic index. The compound offers improved physiochemical properties compared to existing forms of lithium, giving it the potential to be developed as an anti-suicidal drug or for use against mood disorders. The formulation method may also be used for commercial/industrial applications such as green chemistry, engineering low density porous materials, pesticides/herbicides, explosives/propellants, and electronic materials.

Recent evidence suggests that lithium may be efficacious for both the treatment and prevention of Alzheimer’s. Unlike traditional medications which only address a single therapeutic target, lithium appears to be neuroprotective through several modes of action. For example, it exerts neuroprotective effects, in part, by increasing a brain-derived neurotrophic factor leading to restoration of learning and memory. Another neuroprotective mechanism of lithium is attenuation of the production of inflammatory cytokines like IL-6 and nitric oxide in activated microglia. Moreover, results from recent clinical studies suggest that lithium treatment may reduce dementia development while preserving cognitive function and reducing biomarkers associated with AD.

With this in mind, the team of inventors from the University have specifically designed, synthesized and characterized the novel ionic cocrystal of lithium (known as AL001). AL001 has been shown to exhibit improved nonclinical pharmacokinetics compared to current FDA-approved lithium products, it is also bioactive in many in vitro models of Alzheimer’s. AL001 is expected to provide clinicians with a major improvement over current lithium-based treatments and may also constitute a means of treating Alzheimer’s and other neurodegenerative diseases.

A product can be designated as a Breakthrough Therapy designation if it is intended to treat a serious condition and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over available therapy on a clinically significant endpoint(s). A drug that receives Breakthrough Therapy designation is eligible for fast track designation features, intensive guidance on an efficient drug development program and FDA organizational commitment involving senior managers. While the FDA has not given us any indication as to whether AL001 will receive Breakthrough Therapy designation or be permitted to use the 505(b)(2) regulatory pathway, we believe that AL001 is an ideal candidate to receive both a Breakthrough Therapy designation as well as a section 505(b)(2) regulatory pathway for new drug approvals, enhancing the speed and reducing the regulatory burden of FDA review. The Section 505(b)(2) regulatory pathway provides manufacturers with an opportunity to acquire FDA approval without performing all the work required with an NDA. Those drugs that qualify for the 505(b)(2) regulatory pathway are an option for drugs with a new aspect related to indication, dosage form or regimen, strength, combination with other products, or other unique traits. If we receive approval through the 505 (b)(2) regulatory pathway AL001 is eligible for 3-5 years of market exclusivity during which period AL001 would be protected from competitors. If we successfully acquire a Breakthrough Therapy designation and the Section 505(b)(2) regulatory pathway for new drug approvals, we believe we can receive FDA approval for AL001 in four years.

| 7 |

AL001 will require extensive clinical evaluation, regulatory review and approval, significant marketing efforts and substantial investment before it or any successors could provide us with any revenue. As a result, if we do not successfully develop, achieve regulatory approval for and commercialize AL001, our long-term business plans will not be met, and we may be unable to generate the revenue we have forecast for many years, if at all. We do not anticipate that we will generate our maximum revenue for several years, or that we will achieve profitability for this therapeutic at least a few years after generating material revenue, if any. If we are unable to generate revenue, we will not be able to pursue any expansion of our business or acquire additional intellectual property as we have planned, we will not become profitable with this therapeutic agent, and we would be unable to continue our operations as currently planned.

AL002

The other patented solution that we have licensed to move to commercialization is AL002, a mutant-peptide immunotherapy that is designed to be used as a vaccine or prophylactic against Alzheimer’s. This therapy is intended to work by stimulating the body’s own immune system to prevent the formation and breakdown of beta amyloids, which build up in the brain to form a “plaque,” and subsequently block the neurological brain signals, ultimately leading to the symptoms and onset of Alzheimer’s. Immunotherapy is the treatment of disease by inducing, enhancing, or suppressing an immune response. Immunotherapies that are designed to elicit or amplify an immune response are classified as activation immunotherapies, whereas immunotherapies that reduce or suppress are classified as suppression immunotherapies. We believe that strategies to strengthen the immune system in the elderly, who are most susceptible to the development of Alzheimer’s, could greatly enhance the effectiveness of immune-based approaches against Alzheimer’s. Our novel immune-based methodology attempts to inhibit the natural process of immunological aging by restoring the balance of the immune system through immunomodulation.

Beta amyloid protein has been directly linked to Alzheimer’s and the associated neurofibrillary tangles formation seen in Alzheimer’s patients. Specifically, increased levels of extracellular plaques in the brain composed of amyloid beta peptide 1-42 are seen in Alzheimer’s patients when compared to healthy people. In a healthy brain, protein fragments such as amyloid beta peptide 1-42 are broken down and eliminated. However, in individuals with Alzheimer’s, the fragments accumulate to form hard, insoluble plaques. Attempts have been made to help inhibit plaque formation by reducing the amount of amyloid beta peptide 1-42 through vaccines that generate an immune response to the protein. The challenge has been that though effective in reducing the amount of the protein, the inflammatory response has been such that the intended benefits are not seen. These vaccines have used an adjuvant, or helper, to generate the necessary immune response and it is believed that this adjuvant triggers the unwanted surplus inflammation. We have licensed rights to a vaccine using autologous cells that does not require an adjuvant and therefore, we believe will trigger the immune response, which should help eliminate the amyloid beta peptide 1-42 without generating the excess inflammation and therefore, have a positive clinical effect. We believe that the vaccine, in addition to dealing with plaque formation, also ameliorates the impaired immune system that is thought to be the major issue in Alzheimer’s patients.

Our data have demonstrated that these mutant-peptide sensitized dendritic cells (“DC”) can act as a vaccine to generate a durable antibody response, as well as enhance the number of CD8+ T-cells and increase the lifespan of CD8+ cells (T and DCs cells), compared to control subjects. These studies will provide a further rationale and impetus for using this novel vaccine to determine potential efficacy in human clinical trials against Alzheimer’s.

AL002 has been researched for more than 10 years and we are currently in the midst of completing its preclinical development and have begun both the pre-IND and IND application process to the FDA, which is managed by TAMM Net, Inc., an experienced and highly-regarded regulatory consultancy firm. In November 2018, we began a toxicological preclinical study for AL002 with CRL in compliance with FDA requirements. Upon conclusion of this toxicological study, anticipated to occur in the fourth quarter of calendar year 2020, we expect to begin the process of finalizing the IND application process and move quickly forward to begin a Phase 1 Clinical Trial with human subjects. AL002 will require extensive clinical evaluation, regulatory review and approval, significant marketing efforts and substantial investment before it and any successors could provide us with any revenue. As a result, if we do not successfully develop, achieve regulatory approval for and commercialize AL002, our long-term business plans will not be met, and we will be unable to generate the revenue we have forecast for AL002 for many years, if any. We do not anticipate that we will generate our maximum revenue for several years, or that we will achieve profitability for this therapeutic at least a few years after generating material revenue, if any. If we are unable to generate revenue, we will not be able to pursue any expansion of our business or acquire additional intellectual property as we have planned, we will not become profitable with this therapeutic agent, and we would be unable to continue our operations as currently planned.

| 8 |

Our Science

|

Therapeutic Drug

|

Synopsis | Strength | Status |

| AL001 |

• Use of patented Ionic Cocrystal (ICC) technology delivering a therapeutic combination of Lithium, Proline, and Salicylate

• Lithium as a treatment of agitation and other possible symptoms in patients with indication of Alzheimer’s disease

• Other potential indications: Dementia, Parkinson’s Disease, ALS, Depression, Bi-Polar Disorder, Mania, Post Traumatic Stress Disorder (PTSD), Suicidality, etc. |

• Exclusive license for Cocrystal delivery system for AD and psychiatric indications

• Eligible for “breakthrough therapy” designation from FDA

• Seeking a 505(b)(2) clinical trial pathway from FDA

• Formulation may importantly expand the range of therapeutic categories amenable to lithium treatments, with enhanced safety

• Has the potential of becoming the replacement for all lithium therapy on the market

|

• Filed Pre-IND in Q3, 2019

• Planned filing of IND in Q4, 2020

• Planned commencement of Phase 1 human clinical trials in Q4, 2020 |

| AL002 |

• A patented method using a mutant peptide sensitized cell as a cell-based therapeutic vaccine that reduces beta-amyloid plaque and seeks to restore the ability of the patient’s immunological system to combat Alzheimer’s disease.

• Also seeks to mitigate adverse reactions from a patient’s immunological system experienced during pre-clinical trials including the highly publicized Elan study (AN-1972) |

• Adjuvant-free therapeutic vaccine designed for the treatment and prophylactics of AD

• Difficult to manufacture and hence not easily replicated by competitors

• Eligible for “breakthrough therapy” status via FDA

• Antibody responses induced after one inoculation (Pre-Clinical) and lasted for four months

• Inflammation cytokines like IL1 and TNF.alpha, which are considered to be related to inflammation didn't increase with antibody level increase

|

• Completing pre-clinical studies Q4, 2020

• Planned filing IND in Q1, 2021

• Planned commencement of Phase 1 human clinical trials in Q1, 2021 |

Market Opportunity

The Alzheimer’s Association estimates that the cost of caring for people with Alzheimer’s will reach $305 billion dollars in 2020 and by 2050, these costs may rise as high as $1.1 trillion. Currently, Alzheimer’s is the 6th leading cause of death in the U.S. and when extrapolated globally, the market for preventions, treatments, and cures of this crippling disease is massive. Alzamend was formed to develop and commercialize patented intellectual property/treatments for Alzheimer’s, by funding it from pre-clinical through FDA Clinical Trials and ultimately, if successful, make it available to the global market. Additionally, we are supporting ongoing research at the USF Health College of Medicine and plan to support others with first rights of refusal on technologies for treating terminal diseases.

In an article jointly issued on April 8, 2016, Allergan and Heptares cited currently significant unmet medical needs and a heavy economic burden caused by cognitive impairment and dementia across multiple diseases, noting that currently available drugs for treating Alzheimer’s provide limited and transient effects on cognition. They cited projections of healthcare costs, including nursing home care, associated with Alzheimer’s and dementia (currently estimated to be in excess of $640 billion for North America, Western Europe, and Asia-Pacific), that are continuing to grow based on data from the World Health Organization, Alzheimer’s International, the National Institute of Mental Health, and the Lewy Body Dementia Association.

This medical shortfall puts a spotlight on an urgent need for development of new therapies capable of treating the estimated more than 45 million people worldwide suffering from Alzheimer’s today - 5.8 million in North America, 7.5 million in Western Europe, and 3.6 million in the Asia-Pacific region - a number expected to increase to more than 130 million by 2050. Alzheimer’s is the most common cause of dementia, estimated to be associated with some 60 to 70 percent of cases. An additional estimated 1.4 million patients in the U.S. suffer from Lewy body dementia. The potential marketplace for a commercialized therapy or treatment would be tremendously significant with large financial support available from numerous national and international pharmaceutical companies and various governments and worldwide agencies.

| 9 |

These statistics were recently affirmed domestically in an article regarding the death rate and pervasiveness of Alzheimer’s. The rate of deaths related to Alzheimer’s jumped by 54.5 percent over 15 years, according to a report issued on May 27, 2017 from the U.S. Centers for Disease Control and Prevention. There were 93,541 deaths related to Alzheimer’s in 2014, a rate of 25.4 deaths per 100,000 people, up from 44,536 deaths in 1999, a rate of 16.5 deaths per 100,000 people, according to the report. The disease currently affects an estimated 5.8 million people in the U.S., but that number is expected to rise dramatically in people over the age of 65 to 14 million in 2050. The researchers examined death certificate data from the National Vital Statistics System to reach their findings.

Manufacturing

We do not have any in-house manufacturing capabilities. We intend to outsource the manufacturing of our products to third party contractors, with special capabilities to manufacture chemical drugs and biologic drug candidates for submission and clinical testing under FDA guidelines. We believe there will be several sources of manufacturing available once a therapy or treatment can achieve Phase 2 study.

For AL001, we have selected Alcami, a contract development, manufacturing, and testing organization headquartered in North Carolina with over 40 years of experience advancing products through every stage of the development lifecycle. Approximately 900 Alcami employees across six sites in the United States serve biologics and pharmaceutical companies of all sizes, helping to deliver breakthrough therapies to patients faster. Alcami provides customizable and innovative solutions for API development and manufacturing, solid state chemistry, formulation development, analytical development and testing services, clinical and commercial finished dosage form manufacturing (parenteral and oral solid dose), packaging, and stability services.

For AL002, we have selected the worldwide leader and authority in the manufacturing of immunological peptides, Lonza, which is a Swiss multinational, chemicals and biotechnology company, headquartered in Basel, Switzerland, with major facilities in Europe, North America and South Asia. Lonza was established in the late 19th-century in Switzerland. Lonza provides product development services to the pharmaceutical and biologic industries, including organic, fine and performance chemicals, custom manufacturing of biopharmaceuticals, chemical synthesis capabilities, detection systems and services for the bioscience sector.

Distribution & Marketing

We intend to develop AL001 and AL002 through successive de-risking milestones towards regulatory approval and seek marketing approval of AL001 and AL002, or effect partnering transactions with biopharmaceutical companies seeking to strategically fortify pipelines and fund the costly later-stage clinical development required to achieve successful commercialization. We do not anticipate selling products directly into the marketplace, though we may do so depending on market conditions. Our focus is to strategically effect partnering transactions which will provide distribution and marketing capabilities to sell products into the marketplace.

Government Regulation

Clinical trials, the pharmaceutical approval process, and the marketing of pharmaceutical products, are intensively regulated in the U.S. and in all major foreign countries.

Human Health Product Regulation in the U.S.

In the U.S., the FDA regulates pharmaceuticals under the Federal Food, Drug, and Cosmetic Act and related regulations. Pharmaceuticals are also subject to other federal, state, and local statutes and regulations. Failure to comply with applicable U.S. regulatory requirements at any time during the product development process, approval process or after approval may subject an applicant to administrative or judicial sanctions. These sanctions could include the imposition by the FDA of an Institutional Review Board (“IRB”), resulting in a clinical hold on trials, a refusal to approve pending applications, withdrawal of an approval, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties or criminal prosecution. Any agency or judicial enforcement action could have a material adverse effect on us.

| 10 |

The FDA and comparable regulatory agencies in state and local jurisdictions impose substantial requirements upon the clinical development, manufacture and marketing of pharmaceutical products. These agencies and other federal, state and local entities regulate research and development activities and the testing, manufacture, quality control, safety, effectiveness, labeling, storage, distribution, record keeping, approval, advertising and promotion of our products.

The FDA’s policies may change, and additional government regulations may be enacted that could prevent or delay regulatory approval of new disease indications or label changes. We cannot predict the likelihood, nature or extent of adverse governmental regulation that might arise from future legislative or administrative action, either in the U.S. or elsewhere.

Marketing Approval

The process required by the FDA before human health care pharmaceuticals may be marketed in the U.S. generally involves the following:

| • | nonclinical laboratory and, at times, animal tests; |

| • | adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed drug for its intended use or uses; |

| • | pre-approval inspection of manufacturing facilities and clinical trial sites; and |

| • | FDA approval of a Biologics License Application (“BLA”), which must occur before a drug can be marketed or sold. |

We will need to successfully complete extensive clinical trials in order to be in a position to submit a BLA or NDA to the FDA. We must reach agreement with the FDA on the proposed protocols for our future clinical trials in the U.S. A separate submission to the FDA must be made for each successive clinical trial to be conducted during product development. Further, an independent IRB for each site proposing to conduct the clinical trial must review and approve the plan for any clinical trial before it commences at that site, and an informed consent must also be obtained from each study subject. Regulatory authorities, a data safety monitoring board or the sponsor, may suspend or terminate a clinical trial at any time on numerous grounds.

For purposes of BLA or NDA approval for human health products, human clinical trials are typically conducted in phases that may overlap.

| • | Phase I. The drug is initially introduced into healthy human subjects and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion. In the case of some products for severe or life-threatening diseases, especially when the product may be too inherently toxic to ethically administer to healthy volunteers, the initial human testing is often conducted in patients. |

| • | Phase II. This phase involves trials in a limited subject population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage. Phase II studies may be sub-categorized to Phase IIa studies which are smaller, pilot studies to evaluate limited drug exposure and efficacy signals, and Phase IIb studies which are larger studies testing both safety and efficacy more rigorously. |

| • | Phase III. This phase involves trials undertaken to further evaluate dosage, clinical efficacy and safety in an expanded subject population, often at geographically dispersed clinical trial sites. These trials are intended to establish the overall risk/benefit ratio of the product and provide an adequate basis for product labeling. |

All of these trials must be conducted in accordance with Good Clinical Practice (“GCP”) requirements in order for the data to be considered reliable for regulatory purposes.

New Drug and Biologics License Applications

In order to obtain approval to market a pharmaceutical in the U.S., a marketing application must be submitted to the FDA that provides data establishing to the FDA’s satisfaction the safety and effectiveness of the investigational drug for the proposed indication. Each NDA or BLA submission requires a substantial user fee payment unless a waiver or exemption applies (such as with the Orphan Drug Designation discussed below). The NDA or BLA submission fee currently exceeds $1,958,000, and the manufacturer and/or sponsor under an approved NDA or BLA are also subject to annual product and establishment user fees, currently exceeding $98,000 per product and $526,000 per establishment. These fees are typically increased annually. The NDA or BLA includes all relevant data available from pertinent non-clinical studies and clinical trials, including negative or ambiguous results as well as positive findings, together with detailed information relating to the product’s chemistry, manufacturing, controls and proposed labeling, among other things. Data can come from company-sponsored clinical trials intended to test the safety and effectiveness of a use of a product, or from a number of alternative sources, including studies initiated by investigators.

| 11 |

The FDA will initially review the NDA or BLA for completeness before they accept it for filing. The FDA has 60 days from its receipt of an NDA or BLA to determine whether the application will be accepted for filing based on the agency’s threshold determination that the application is sufficiently complete to permit substantive review. After the NDA or BLA submission is accepted for filing, the FDA reviews the NDA or BLA to determine, among other things, whether the proposed product is safe and effective for its intended use, and whether the product is being manufactured in accordance with current Good Manufacturing Practices (“cGMP”) to assure and preserve the product’s identity, strength, quality and purity. The FDA may refer applications for novel drug products or drug products that present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved and, if so, under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions.

Based on pivotal Phase III trial results submitted in an NDA or BLA, upon the request of an applicant, the FDA may grant a Priority Review designation to a product, which sets the target date for FDA action on the application at six to eight months, rather than the standard ten to twelve months. The FDA can extend these reviews by three months. Priority Review is given where preliminary estimates indicate that a product, if approved, has the potential to provide a significant improvement compared to marketed products or offers a therapy where no satisfactory alternative therapy exists. Priority Review designation does not change the scientific/medical standard for approval or the quality of evidence necessary to support approval.

After the FDA completes its initial review of an NDA or BLA, it will communicate to the sponsor that the drug will either be approved, or it will issue a complete response letter to communicate that the NDA or BLA will not be approved in its current form and inform the sponsor of changes that must be made or additional clinical, nonclinical or manufacturing data that must be received before the application can be approved, with no implication regarding the ultimate approvability of the application.

Before approving an NDA or BLA, the FDA will inspect the facilities at which the product is manufactured, even if such facilities are located overseas. The FDA will not approve the product unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications.

Additionally, before approving an NDA or BLA, the FDA may inspect one or more clinical sites to assure compliance with GCP. If the FDA determines that any of the application, manufacturing process or manufacturing facilities is not acceptable, it typically will outline the deficiencies and often will request additional testing or information. This may significantly delay further review of the application. If the FDA finds that a clinical site did not conduct the clinical trial in accordance with GCP, the FDA may determine that the data generated by the clinical site should be excluded from the primary efficacy analyses provided in the NDA or BLA. Additionally, notwithstanding the submission of any requested additional information, the FDA ultimately may decide that the application does not satisfy the regulatory criteria for approval.

The testing and approval process for a drug requires substantial time, effort and financial resources, and this process may take up to several years to complete. Data obtained from clinical activities are not always conclusive and may be susceptible to varying interpretations, which could delay, limit or prevent regulatory approval. The FDA may not grant approval on a timely basis, or at all. We may encounter difficulties or unanticipated costs in our efforts to secure necessary governmental approvals, which could delay or preclude us from marketing our products.

The FDA may require, or companies may pursue, additional clinical trials after a product is approved. These so-called Phase IV studies may be made a condition to be satisfied for continuing drug approval. The results of Phase IV studies can confirm the effectiveness of a product candidate and can provide important safety information. In addition, the FDA now has express statutory authority to require sponsors to conduct post-market studies to specifically address safety issues identified by the agency. Any approvals that we may ultimately receive could be withdrawn if required post-marketing trials or analyses do not meet the FDA requirements, which could materially harm the commercial prospects for AL001 or AL002.

| 12 |

The FDA also has authority to require a Risk Evaluation and Mitigation Strategy (“REMS”) from manufacturers to ensure that the benefits of a drug or biological product outweigh its risks. A sponsor may also voluntarily propose a REMS as part of the NDA or BLA submission. The need for a REMS is determined as part of the review of the NDA or BLA. Based on statutory standards, elements of a REMS may include “dear doctor letters,” a medication guide, more elaborate targeted educational programs, and in some cases restrictions on distribution. These elements are negotiated as part of the NDA or BLA approval, and in some cases if consensus is not obtained until after the Prescription Drug User Fee Act review cycle, the approval date may be delayed. Once adopted, REMS are subject to periodic assessment and modification.

Even if AL001 or AL002 receive regulatory approval, the approval may be limited to specific disease states, patient populations and dosages, or might contain significant limitations on use in the form of warnings, precautions or contraindications, or in the form of onerous risk management plans, restrictions on distribution, or post-marketing study requirements. Further, even after regulatory approval is obtained, later discovery of previously unknown problems with a product may result in restrictions on the product or even complete withdrawal of the product from the market. Any delay in obtaining, or failure to obtain, regulatory approval for AL001 or AL002, or obtaining approval only for significantly limited use, would harm our business. In addition, we cannot predict what adverse governmental regulations may arise from future U.S. or foreign governmental action.

Disclosure of Clinical Trial Information

Sponsors of clinical trials of certain FDA-regulated products, including prescription drugs, are required to register and disclose certain clinical trial information on a public website maintained by the U.S. National Institutes of Health. Information related to the product, patient population, phase of investigation, study sites and investigator, and other aspects of the clinical trial is made public as part of the registration. Sponsors are also obligated to disclose the results of these trials after completion. Disclosure of the results of these trials can be delayed until the product or new indication being studied has been approved. Competitors may use this publicly-available information to gain knowledge regarding the design and progress of our development programs.

The Drug Price Competition and Patent Term Restoration Act

The Drug Price Competition and Patent Term Restoration Act, also known as the Hatch-Waxman Act, requires pharmaceutical companies to divulge certain information regarding their products which has the effect of making it easier for other companies to manufacture generic drugs to compete with those products.

Patent Term Extension. After an NDA or BLA approval, owners of relevant drug patents may apply for up to a five-year patent extension. The allowable patent term extension is calculated as half of the drug’s testing phase - the time between IND submission and NDA or BLA submission - and all of the review phase - the time between either NDA or BLA submission and approval, up to a maximum of five years. The time can be shortened if FDA determines that the applicant did not pursue approval with due diligence. The total patent term after the extension may not exceed 14 years.

For patents that might expire during the application phase, the patent owner may request an interim patent extension. An interim patent extension increases the patent term by one year and may be renewed up to four times. For each interim patent extension granted, the post-approval patent extension is reduced by one year. The director of the PTO must determine that approval of the drug covered by the patent for which a patent extension is being sought is likely. Interim patent extensions are not available for a drug for which an NDA or BLA has not been submitted.

Environmental Regulations. The U.S. generally requires an environmental assessment, which discusses a company’s proposed action, possible alternatives to the action, and whether the further analysis of an environmental impact statement is necessary. Certain exemptions are available from the requirement to perform an environmental assessment and an environmental impact statement. Once an exemption is claimed, a company must state to the FDA that no extraordinary circumstances exist that may significantly affect the environment. We may claim an exemption, under the category for biologic products, from the requirement to provide an environmental assessment and an environmental impact statement for AL001 or AL002 and may furthermore state to the FDA that to our knowledge, no extraordinary circumstances exist that would significantly affect the environment.

| 13 |

FDA Post-Approval Requirements

Following the approval of an NDA or BLA, the FDA continues to require adverse event reporting and submission of periodic reports. The FDA also may require post-marketing testing, known as Phase IV testing, REMS, and surveillance to monitor the effects of an approved product, or the FDA may place conditions on an approval that could restrict the distribution or use of the product. In addition, quality control, drug manufacture, packaging, and labeling procedures must continue to conform to cGMP after approval. Drug manufacturers and certain of their subcontractors are required to register their establishments with FDA and certain state agencies. Registration with the FDA subjects entities to periodic unannounced inspections by the FDA, during which the agency inspects manufacturing facilities to assess compliance with cGMP. Accordingly, manufacturers must continue to expend time, money and effort in the areas of production and quality control to maintain compliance with cGMP. Regulatory authorities may withdraw product approvals or request product recalls if a company fails to comply with regulatory standards, if it encounters problems following initial marketing, or if previously unrecognized problems are subsequently discovered.

Patient Protection and Affordable Care Act

In March 2010, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act (collectively, the “ACA”), which includes measures that have significantly changed the way health care is financed by both governmental and private insurers, became law in the U.S. The ACA is a sweeping measure intended to expand health care coverage within the U.S., primarily through the imposition of health insurance mandates on employers and individuals and expansion of the Medicaid program. The ACA has significantly impacted the pharmaceutical industry. The ACA requires discounts under the Medicare drug benefit program and increased rebates on drugs covered by Medicaid. In addition, the ACA imposes an annual fee, which increases annually, on sales by branded pharmaceutical manufacturers. At this time, the financial impact of these discounts, increased rebates and fees and the other provisions of the ACA on our business are unclear. However, the fees, discounts and other provisions of this law are expected to have a significant negative effect on the profitability of pharmaceuticals.

Human Health Product Regulation in the European Union

In addition to regulations in the U.S., we may eventually be subject, either directly or through our distribution partners, to a variety of regulations in other jurisdictions governing, among other things, clinical trials and any commercial sales and distribution of our products, if approved.

Whether or not we obtain FDA approval for a product, we must obtain the requisite approvals from regulatory authorities in non-U.S. countries prior to the commencement of clinical trials or marketing of the product in those countries. Certain foreign countries have a process that requires the submission of a clinical trial application prior to the commencement of human clinical trials. In Europe, for example, a Clinical Trial Application (“CTA”) must be submitted to the competent national health authority and to independent ethics committees in each country in which a company intends to conduct clinical trials. Once the CTA is approved in accordance with a country’s requirements, clinical trial development may proceed in that country.

The requirements and process governing the conduct of clinical trials, product licensing, pricing and reimbursement vary from country to country, even though there is already some degree of legal harmonization in the EU Member States resulting from the national implementation of underlying EU legislation. In all cases, the clinical trials are conducted in accordance with GCP and other applicable regulatory requirements.

To obtain regulatory approval of an investigational drug under EU regulatory systems, we must submit a marketing authorization application. This application is similar to the BLA in the U.S., with the exception of, among other things, country-specific document requirements. Drugs can be authorized in the EU by using (i) the centralized authorization procedure, (ii) the mutual recognition procedure, (iii) the decentralized procedure or (iv) national authorization procedures.

The European Medicines Agency (“EMA”) implemented the centralized procedure for the approval of human drugs to facilitate marketing authorizations that are valid throughout the EU. This procedure results in a single marketing authorization granted by the European Commission that is valid across the EU, as well as in Iceland, Liechtenstein and Norway (the “European Economic Area”). The centralized procedure is compulsory for human drugs that are: (i) derived from biotechnology processes, such as genetic engineering, (ii) contain a new active substance indicated for the treatment of certain diseases, such as HIV/AIDS, cancer, diabetes, neurodegenerative diseases, autoimmune and other immune dysfunctions and viral diseases, (iii) officially designated orphan drugs, and (iv) advanced-therapy medicines, such as gene-therapy, somatic cell-therapy or tissue-engineered medicines. The centralized procedure may at the request of the applicant also be used for human drugs which do not fall within the above mentioned categories if the human drug (a) contains a new active substance which, on the date of entry into force of Regulation (EC) No. 726/2004, was not authorized in the European Economic Area; or (b) the applicant shows that the medicinal product constitutes a significant therapeutic, scientific or technical innovation or that the granting of authorization in the centralized procedure is in the interests of patients at European Economic Area level.

| 14 |

Under the centralized procedure in the EU, the maximum timeframe for the evaluation of a Marketing Authorization Application (“MAA”) by the EMA is 210 days, though the date count stops whenever the Committee for Medicinal Products for Human Use (“CHMP”) asks the applicant for additional written or oral information, with adoption of the actual marketing authorization by the European Commission thereafter. Accelerated evaluation might be granted by the CHMP in exceptional cases, as when a medicinal product is expected to be of a major public health interest from the point of view of therapeutic innovation, defined by three cumulative criteria: (i) the seriousness of the disease to be treated; (ii) the absence of an appropriate alternative therapeutic approach; and (iii) anticipation of exceptional high therapeutic benefit. In this circumstance, EMA ensures that the evaluation for the opinion of the CHMP is completed within 150 days and the opinion issued thereafter. We plan to submit an application for marketing authorizations in the United States for AL001 and AL002 in the first half of 2021.

The Mutual Recognition Procedure (“MRP”), for the approval of human drugs is an alternative approach to facilitate individual national marketing authorizations within the EU. Essentially, the MRP may be applied for all drugs designed to be used by humans for which the centralized procedure is not obligatory. The MRP is applicable to the majority of conventional medicinal products and is based on the principle of recognition of an already existing national marketing authorization by one or more Member States.

The characteristic of the MRP is that the procedure builds on an already existing marketing authorization in a Member State of the EU that is used as reference in order to obtain marketing authorizations in other EU Member States. In the MRP, a marketing authorization for a drug already exists in one or more Member States of the EU and subsequently marketing authorization applications are made in other EU Member States by referring to the initial marketing authorization. The Member State in which the marketing authorization was first granted will then act as the reference Member State. The Member States where the marketing authorization is subsequently applied for act as concerned Member States.

The MRP is based on the principle of the mutual recognition by EU Member States of their respective national marketing authorizations. Based on a marketing authorization in the reference Member State, the applicant may apply for marketing authorizations in other Member States. In such case, the reference Member State shall update its existing assessment report on the drug in 90 days. After the assessment is completed, copies of the report are sent to all Member States, together with the approved summary of product characteristics, labeling and package leaflet. The concerned Member States then have 90 days to recognize the decision of the reference Member State and the summary of product characteristics, labeling and package leaflet. National marketing authorizations shall be granted within 30 days after acknowledgement of the agreement.

Should any Member State refuse to recognize the marketing authorization by the reference Member State, on the grounds of potential serious risk to public health, the issue will be referred to a coordination group. Within a timeframe of 60 days, Member States shall, within the coordination group, make all efforts to reach a consensus. If this fails, the procedure is submitted to an EMA scientific committee for arbitration. The opinion of this EMA Committee is then forwarded to the Commission, for the start of the decision-making process. As in the centralized procedure, this process entails consulting various European Commission Directorates General and the Standing Committee on Human Medicinal Products.

Human Health Product Regulation in the Rest of World

For other countries outside of the EU, such as countries in Eastern Europe or Asia, the requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement vary from country to country. In all cases, again, the clinical trials are conducted in accordance with GCP and the other applicable regulatory requirements. If we fail to comply with applicable foreign regulatory requirements, we may be subject to, among other things, fines, suspension of clinical trials, suspension or withdrawal of regulatory approvals, product recalls, seizure of products, operating restrictions and criminal prosecution.

Other Regulatory Considerations

Labeling, Marketing and Promotion

Once an NDA or BLA is approved, a product will be subject to certain post-approval requirements. For instance, the FDA closely regulates the post-approval marketing and promotion of pharmaceuticals, including standards and regulations for direct-to-consumer advertising, off-label promotion, industry-sponsored scientific and educational activities and promotional activities on the internet and elsewhere.

| 15 |

While doctors are free to prescribe any pharmaceutical approved by the FDA for any use, a company can only make claims relating to the safety and efficacy of a pharmaceutical that are consistent with the FDA approval, and is only allowed to actively market a pharmaceutical for the particular indication approved by the FDA. Changes to some of the conditions established in an approved application, including changes in indications, labeling, or manufacturing processes or facilities, require submission and FDA approval of a new NDA or BLA or NDA/BLA supplement before the change can be implemented. A BLA supplement for a new indication typically requires clinical data similar to that in the original application, and the FDA uses the same procedures and actions in reviewing supplements as it does in reviewing NDAs.

In addition, any claims we make for our products in advertising or promotion must be appropriately balanced with important safety information and otherwise be adequately substantiated. Failure to comply with these requirements can result in adverse publicity, warning letters, corrective advertising, injunctions and potential civil and criminal penalties. Government regulators recently have increased their scrutiny of the promotion and marketing of pharmaceuticals.

Anti-Kickback and False Claims Laws

In the U.S., we are subject to complex laws and regulations pertaining to health care “fraud and abuse,” including, but not limited to, the Medicare and Medicaid Patient Protection Act of 1987 (also known as the federal “Anti-Kickback Statute”), the federal False Claims Act, state false claims acts and other state and federal laws and regulations. The Anti-Kickback Statute makes it illegal for any person, including a prescription drug manufacturer (or a party acting on its behalf) to knowingly and willfully solicit, receive, offer, or pay any remuneration that is intended to induce the referral of business, including the purchase, order, or prescription of a particular pharmaceutical, for which payment may be made under a federal health care program, such as Medicare or Medicaid.

The federal False Claims Act prohibits anyone from knowingly presenting, or causing to be presented, for payment to federal programs (including Medicare and Medicaid) claims for items or services, including pharmaceuticals, that are false or fraudulent, claims for items or services not provided as claimed, or claims for medically unnecessary items or services.

There are also an increasing number of state laws that require manufacturers to make reports to states on pricing and marketing information. Many of these laws contain ambiguities as to what is required to comply with the laws. In addition, beginning in 2013, a similar federal law requires manufacturers to track and report to the federal government certain payments made to physicians and teaching hospitals made in the previous calendar year. These laws may affect our sales, marketing, and other promotional activities by imposing administrative and compliance burdens on us. In addition, given the lack of clarity with respect to these laws and their implementation, our reporting actions could be subject to the penalty provisions of the pertinent state, and soon federal, authorities.

Other Health Care Laws and Compliance Requirements