UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant | x | |

| Filed by a Party other than the Registrant | ¨ | |

| Check the appropriate box: | ||

| x | Preliminary Proxy Statement | |

| ¨ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 | |

ALZAMEND NEURO, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

ALZAMEND NEURO, INC.

3480 Peachtree Road NE, Second Floor, Suite 103

Atlanta, GA 30326

March __, 2024

Dear Stockholder:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders (“Annual Meeting”) of Alzamend Neuro, Inc. (“Alzamend Neuro” or the “Company”) The Annual Meeting will be held on April 30, 2024 at 12:00 p.m. ET. The Annual Meeting will be held in a virtual meeting format only. You can attend the Annual Meeting online and vote your shares electronically during the Annual Meeting by visiting meetnow.global/XXXXXX. You will not be able to attend the Annual Meeting in person.

Details regarding admission to the Annual Meeting and the business to be conducted are more fully described in the accompanying Notice of 2024 Annual Meeting of Stockholders and Proxy Statement.

The agenda for this Annual Meeting includes (i) the election of eight (8) directors, (ii) the ratification of the appointment of Baker Tilly US, LLP as Alzamend Neuro’s independent registered public accounting firm for the fiscal year ending April 30, 2024, (iii) the approval, for purposes of complying with Listing Rule 5635 of The Nasdaq Stock Market, LLC, the issuance by Alzamend Neuro of additional shares of Alzamend Neuro’s Common Stock issuable upon the (A) conversion of up to 6,000 shares of Alzamend Neuro’s Series B convertible preferred stock and (B) exercise of warrants to purchase up to 6,000,000 shares of Common Stock, for a total purchase price of up to $6,000,000.00, pursuant to the Securities Purchase Agreement dated January 31, 2024 with Ault Lending, LLC, and (iv) the approval an amendment to Alzamend Neuro’s Certificate of Incorporation to effect a reverse stock split of the Common Stock by a ratio of not less than one-for-two and not more than one-for-twenty at any time prior to April 29, 2025, with the exact ratio to be set at a whole number within this range as determined by the Board of Directors in its sole discretion.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, please carefully review the Proxy Statement and then cast your vote, regardless of the number of shares you hold. If you are a stockholder of record, you may vote over the Internet, by telephone, or by completing, signing, dating and mailing the accompanying proxy card in the return envelope. Submitting your vote via the Internet in advance of the Annual Meeting or by telephone or proxy card will not affect your right to vote during the Annual Meeting if you decide to attend the Annual Meeting. If your shares are held in street name (held for your account by a broker or other nominee), you will receive instructions from your broker or other nominee explaining how to vote your shares, and you will have the option to cast your vote by telephone or over the Internet in advance of the Annual Meeting if your voting instruction form from your broker or nominee includes instructions and a toll-free telephone number or Internet website to do so. In any event, to be sure that your vote will be received in time, please cast your vote by your choice of available means at your earliest convenience.

We hope that you will join us on April 30, 2024. Your continuing interest in Alzamend Neuro is very much appreciated.

Sincerely,

/s/ Stephan Jackman

Stephan Jackman

Chief Executive Officer

You are cordially invited to attend the Annual Meeting. Whether or not you expect to attend the Annual Meeting virtually, please vote by telephone, through the Internet or by completing and returning the proxy card mailed to you, as promptly as possible in order to ensure your representation at the Annual Meeting. Voting instructions are printed on your proxy card and included in the accompanying Proxy Statement. If you participate virtually in the Annual Meeting, you may vote at that time, even if you previously submitted your vote. Please note, however, that if your shares are held of record by a brokerage firm, bank or other agent and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that agent in order to vote your shares that are held in such agent's name and account.

PRELIMINARY PROXY STATEMENT

(SUBJECT TO COMPLETION)

Alzamend Neuro, Inc.

3480 Peachtree Road NE

Second Floor, Suite 103

Atlanta, GA 30326

(844) 722-6333

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

| Time | 12:00 p.m., Eastern time |

| Date | Tuesday, April 30, 2024 |

| Virtual Meeting | The Annual Meeting will be a virtual meeting through which you can listen to the meeting and vote online. To access the virtual meeting please click the Virtual Stockholder Meeting link: meetnow.global/XXXXXX. To login to the virtual meeting you have two options: Join as a “Guest” or Join as a “Stockholder.” If you join as a “Stockholder” you will be required to have a control number. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. |

| Purpose | (1) | To elect the Board of Directors’ nominees, William B. Horne, Milton C. Ault, III, Stephan Jackman, Henry Nisser, Mark Gustafson, Lynne F. McGrath, Andrew H. Woo and Jeffrey Oram, as members of the Board of Directors, to serve until the 2025 annual meeting of stockholders (the “2025 Annual Meeting”) and until their successors are duly elected and qualified. |

| (2) | To ratify the selection of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2024. | |

| (3) | To approve, for purposes of complying with Listing Rule 5635 of The Nasdaq Stock Market, LLC (“Nasdaq”), the issuance by the Company of additional shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) issuable upon the (i) conversion of up to 6,000 shares of the Company’s Series B convertible preferred stock (the “Series B Preferred Stock”), and (ii) exercise of warrants (the “Series B Warrants”) to purchase up to 6,000,000 shares of Common Stock, for a total purchase price of up to $6,000,000.00, pursuant to the Securities Purchase Agreement dated January 31, 2024 with Ault Lending, LLC (“Ault Lending”). | |

| (4) | To approve an amendment to our Certificate of Incorporation (the “Certificate”) to effect a reverse stock split of the Common Stock by a ratio of not less than one-for-two and not more than one-for-twenty at any time prior to April 29, 2025, with the exact ratio to be set at a whole number within this range as determined by the Board of Directors in its sole discretion. | |

| (5) | To transact any other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. | |

| These items of business are more fully described in the Proxy Statement accompanying this notice. | ||

| Record Date |

The Board of Directors has fixed the close of business on _________, 2024 (the “Record Date”) as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting.

A list of stockholders entitled to vote at the Annual Meeting will be available for inspection by any stockholder of record for purposes germane to the Annual Meeting for a period of ten (10) days prior to the Annual Meeting. Please contact the Secretary of the Company to make arrangements to inspect the list. In addition, during the Annual Meeting, that list of stockholders will be available for examination by any stockholder of record. |

By order of the Board of Directors,

/s/ Stephan Jackman

Stephan Jackman

Chief Executive Officer

Atlanta, Georgia

March __, 2024

Important Notice Regarding the Availability of Proxy Materials for the Alzamend Neuro 2024 Annual Meeting of Stockholders to Be Held on April 30, 2024. This Notice of Annual Meeting of Stockholders and the accompanying Proxy Statement are available on the Internet at www.envisionreports.com/ALZN for registered holders and http://www.edocumentview.com/ALZN for street holders.

| TABLE OF CONTENTS | |

| Page | |

| GENERAL INFORMATION | 1 |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS | 7 |

| General | 7 |

| Information about the Nominees | 7 |

| Involvement in Certain Legal Proceedings | 9 |

| Family Relationships | 10 |

| Board Independence | 10 |

| Board Meetings and Attendance | 11 |

| Board Committees | 11 |

| Certain Board Arrangements | 14 |

| Board Diversity | 15 |

| Leadership Structure and Risk Oversight | 15 |

| Section 16(a) Beneficial Ownership Reporting Compliance | 16 |

| Code of Business Conduct and Ethics | 16 |

| Stockholder Communications with Our Board of Directors | 16 |

| Director Compensation | 16 |

| Vote Required | 16 |

| Our Recommendation | 16 |

| PROPOSAL NO. 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 17 |

| Independent Registered Public Accounting Firm Fees | 17 |

| Pre-Approval Policy | 17 |

| Review of the Company’s Audited Financial Statements for the Fiscal Year Ended April 30, 2023 | 17 |

| Report of the Audit Committee of the Board of Directors | 18 |

| Vote Required | 18 |

| Our Recommendation | 18 |

| PROPOSAL 3: APPROVAL, FOR PURPOSES OF COMPLYING WITH LISTING RULE 5635 OF NASDAQ, THE ISSUANCE BY THE COMPANY OF ADDITIONAL SHARES OF COMMON STOCK ISSUABLE UPON THE (i) CONVERSION OF UP TO 6,000 SHARES OF SERIES B PREFERRED STOCK AND (ii) EXERCISE OF THE SERIES B WARRANTS, FOR A TOTAL PURCHASE PRICE OF UP TO $6,000,000.00, PURSUANT TO THE SECURITIES PURCHASE AGREEMENT DATED JANUARY 31, 2024 WITH AULT LENDING | 19 |

| Description of the SPA and the SPA Securities | 19 |

| Stockholder Approval Requirement | 20 |

| Reasons for Transaction | 21 |

| Effect on Current Stockholders; Dilution | 21 |

| Vote Required | 21 |

| Our Recommendation | 21 |

| PROPOSAL 4: APPROVAL OF THE AMENDMENT TO THE COMPANY’S CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF COMMON STOCK | 22 |

| Background and Reasons for the Reverse Stock Split; Potential Consequences of the Reverse Stock Split | 22 |

| No Going Private Transaction | 23 |

| Procedure for Implementing the Reverse Stock Split | 23 |

| Effect of the Reverse Stock Split on Holders of Outstanding Common Stock | 23 |

| Beneficial Holders of Common Stock (i.e., stockholders who hold in street name) | 24 |

| Registered “Book-Entry” Holders of Common Stock (i.e., stockholders whose names are registered on the transfer agent’s books and records but do not hold stock certificates) | 24 |

| Holders of Certificated Shares of Common Stock | 24 |

| Fractional Shares | 25 |

| Effect of the Reverse Stock Split on Employee Plans, Options, Restricted Stock Awards, Warrants and Convertible or Exchangeable Securities | 25 |

| Accounting Matters | 25 |

| Certain Federal Income Tax Consequences of the Reverse Stock Split | 25 |

| U.S. Holders | 26 |

| No Appraisal Rights | 26 |

| Vote Required | 26 |

| Our Recommendation | 26 |

| INFORMATION ABOUT THE EXECUTIVE OFFICERS | 27 |

| Executive Officers | 27 |

| Involvement in Certain Legal Proceedings | 27 |

| i |

| EXECUTIVE COMPENSATION | 28 |

| Summary Compensation Table | 28 |

| Employment Agreements | 28 |

| CEO Pay Ratio | 29 |

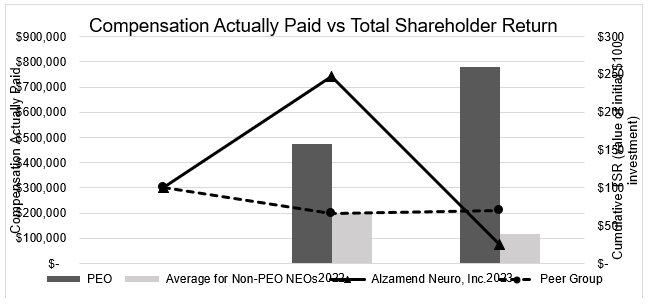

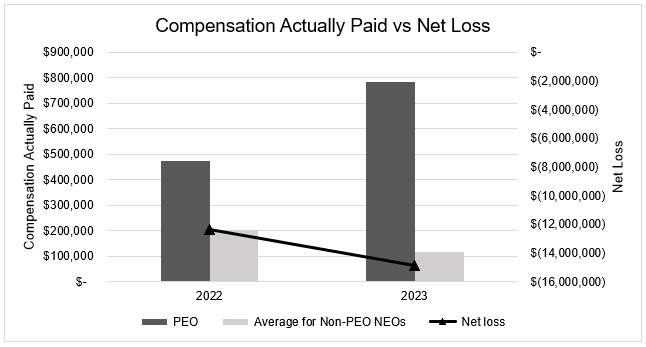

| Pay Versus Performance | 30 |

| Policies on Ownership, Insider Trading, 10b5-1 Plans and Hedging | 32 |

| Outstanding Equity Awards at Fiscal Year End | 32 |

| Incentive Compensation Plans | 32 |

| Equity Compensation Information | 36 |

| Limitation on Liability and Indemnification Agreements | 36 |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 37 |

| Certain Relationships | 37 |

| Transactions with Related Persons | 37 |

| Future Transactions | 38 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 39 |

| HOUSEHOLDING | 40 |

| PROPOSALS OF STOCKHOLDERS FOR THE 2025 ANNUAL MEETING | 40 |

| OTHER MATTERS | 41 |

| ii |

Alzamend Neuro, Inc.

3480 Peachtree Road NE

Second Floor, Suite 103

Atlanta, GA 30326

(844) 722-6333

PRELIMINARY PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 30, 2024

AT 12:00 P.M. ET

GENERAL INFORMATION

When are this Proxy Statement and the accompanying materials scheduled to be sent to stockholders?

On or about _______, 2024, we mailed you the Notice of 2024 Annual Meeting of Stockholders (“Notice of Annual Meeting”), this Proxy Statement (the “Proxy Statement”), a proxy card and the Annual Report on Form 10-K for the year ended April 30, 2023 (collectively, the “Proxy Materials”). The Proxy Materials are also available on the Internet at www.envisionreports.com/ALZN for registered holders and http://www.edocumentview.com/ALZN for street holders.

As used in this Proxy Statement, “we,” “us,” “our,” “Alzamend Neuro” and “the Company” refer to Alzamend Neuro, Inc. The term “Annual Meeting,” as used in this Proxy Statement, includes any adjournment or postponement of such meeting.

Why is Alzamend Neuro conducting a virtual Annual Meeting?

We are using the latest technology in order to provide expanded access, improved communication and cost savings for our stockholders and the Company. We believe that hosting a virtual meeting will enable more of our stockholders to safely attend and participate in the Annual Meeting since our stockholders can participate from any location around the world with Internet access. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting, including the ability to vote.

How do I attend the Annual Meeting?

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the Annual Meeting. No physical meeting will be held.

You will be able to attend the Annual Meeting online by visiting meetnow.global/XXXXXX. To log in to the virtual meeting you have two options: Join as a “Guest” or Join as a “Stockholder.” If you join as a “Stockholder” you will be required to have a control number. You also will be able to vote your shares online by attending the Annual Meeting by webcast.

To participate in the Annual Meeting, you will need to review the information included on your Notice of Annual Meeting, on your proxy card or on the instructions that accompanied your Proxy Materials.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below. The online meeting will begin promptly at 12:00 p.m., Eastern Time. We encourage you to access the Annual Meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this Proxy Statement.

| 1 |

How do I register to attend the Annual Meeting virtually on the Internet?

If you are a registered stockholder (i.e., you hold your shares through our transfer agent, Computershare Trust Company, N.A. (“Computershare”)), you do not need to register to attend the Annual Meeting virtually on the Internet. Please follow the instructions on the notice or proxy card that you received.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting virtually on the Internet.

To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your ownership of Common Stock along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on April 29, 2024. You will receive a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to Computershare by:

| By email: | Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com | ||

| By mail: | Computershare Trust Company, N.A. | ||

| Alzamend Neuro Legal Proxy | |||

| P.O. Box 43001 | |||

| Providence, RI 02940-3001 |

When is the record date for the Annual Meeting?

The Board of Directors (the “Board”) has fixed the Record Date for the Annual Meeting as of the close of business on _________, 2024.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. As of the Record Date, there were issued and outstanding (i) ________ shares of Common Stock and (ii) _____ shares of Series B Preferred Stock, which together constitute all of the outstanding voting capital stock of the Company. Stockholders are entitled to one vote for each share of Common Stock held by them. The Series B Preferred Stock votes on an as-converted basis with the Common Stock. As of the Record Date, the outstanding shares of Series B Preferred Stock were convertible into _______ shares of Common Stock for an aggregate of __________ shares of capital stock that may be voted at the Annual Meeting.

A majority of the total votes entitled to be cast will constitute a quorum at the Annual Meeting.

Stockholder of Record: Shares Registered in Your Name

If, on the Record Date, your shares were registered directly in your name with Computershare, then you are a stockholder of record. As a stockholder of record, you may vote at the Annual Meeting, vote by proxy over the telephone or through the Internet, or vote by proxy using the proxy card that was sent to you in the Proxy Materials. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Similar Organization

If, on the Record Date, your shares were held, not in your name but rather in an account at a brokerage firm, bank, dealer or other similar organization (the “record holder”), then you are the beneficial owner of shares held in “street name” and the Proxy Materials are being made available to you by the record holder or “nominee,” along with voting instructions. As the beneficial owner, you have the right to direct the record holder how to vote your shares, and the record holder is required to vote your shares in accordance with your instructions. If you do not give instructions to your record holder, it will not be entitled to vote your shares on any proposal, except the proposal for the ratification of auditors, which is a routine item.

| 2 |

As the beneficial owner of shares, you are invited to attend the Annual Meeting. If you are a beneficial owner, however, you may not vote your shares at the Annual Meeting unless you obtain a legal proxy, executed in your favor, from the record holder of your shares.

How do I vote?

Either (1) mail your completed and signed proxy card(s) to Alzamend Neuro, Inc., 3480 Peachtree Road NE, Second Floor, Suite 103, Atlanta, GA 30326, Attention: Corporate Secretary, (2) call the toll-free number printed on your proxy card(s) and follow the recorded instructions or (3) visit the website indicated on your proxy card(s) and follow the on-line instructions. If you are a registered stockholder and attend the Annual Meeting, then you may deliver your completed proxy card(s) or vote pursuant to the instructions on the proxy card. If your shares are held by your broker or bank, in “street name,” then you will receive a form from your broker or bank seeking instructions as to how your shares should be voted. If you do not give instructions to your record holder, it will nevertheless be entitled to vote your shares in its discretion on the ratification of the appointment of the independent registered public accounting firm (Proposal No. 4), but not on any other proposal.

| Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies. |

What are the Board’s recommendations on how to vote my shares?

The Board recommends a vote:

Proposal 1: FOR the election of the eight (8) director nominees (page 8);

Proposal 2: FOR ratification of the selection of Baker Tilly US, LLP as the Company’s independent registered public accounting firm (page 19);

Proposal 3: FOR approval, for purposes of complying with Listing Rule 5635 of Nasdaq, the issuance by the Company of additional shares of the Company’s Common Stock issuable upon the (i) conversion of up to 6,000 shares of Series B Preferred Stock and (ii) exercise of the Series B Warrants to purchase up to 6,000,000 shares of Common Stock, for a total purchase price of up to $6,000,000.00, pursuant to the Securities Purchase Agreement dated January 31, 2024 with Ault Lending (the “Series B Proposal”) (page 21); and

Proposal 4: FOR approval of the proposal to amend the Certificate to effect a reverse stock split of our Common Stock by a ratio of not less than one-for-two and not more than one-for-twenty at any time prior to April 29, 2025, with the exact ratio to be set at a whole number within this range as determined by the Board of Directors in its sole discretion (the “Reverse Split Proposal”) (page 25).

Who pays the cost for soliciting proxies?

We will pay the entire cost of soliciting proxies. In addition to these Proxy Materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokers, banks, custodians, other nominees and fiduciaries for forwarding these materials to their principals to obtain the authorization for the execution of proxies.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote but do not make specific choices?

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the Internet or online at the Annual Meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “FOR” the election of each nominee for director, “FOR” ratification of the selection of Baker Tilly US, LLP as our independent registered public accounting firm, “FOR” the Series B Proposal and “FOR” the Reverse Split Proposal. If any other matter is properly presented at the Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

| 3 |

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. Under the rules of the New York Stock Exchange (“NYSE”), brokers, banks and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. Proposals 1, 3 and 4 are considered to be “non-routine” under NYSE rules meaning that your broker may not vote your shares on those proposals in the absence of your voting instructions. However, Proposal 2 is considered to be a “routine” matter under NYSE rules meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 2.

If you are a beneficial owner of shares held in street name, and you do not plan to attend the Annual Meeting, in order to ensure that your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials that you receive from your broker, bank or other agent.

Can I change my vote?

Stockholder of Record: Shares Registered in Your Name

Yes. If you are the stockholder of record for your shares, you may revoke your proxy at any time before the final vote at the Annual Meeting in one of the following ways:

| • | by notifying our Secretary in writing at 3480 Peachtree Road NE, Second Floor, Suite 103, Atlanta, GA 30326 that you are revoking your proxy; | |

| • | by submitting another properly completed proxy with a later date; | |

| • | by transmitting a subsequent vote over the Internet or by telephone prior to by 11:00 a.m., Eastern Time on April 30, 2024; or | |

| • | by attending and voting online during the Annual Meeting. |

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Similar Organization

If your shares are held in street name, you must contact your broker or nominee for instructions as to how to change your vote. Your attendance at the Annual Meeting does not revoke your proxy. Your last vote, whether prior to or at the Annual Meeting, is the vote that we will count.

How is a quorum reached?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the total votes entitled to be cast are present at the Annual Meeting or represented by proxy. Shares held of record by stockholders or brokers, bankers or other nominees who do not return a valid proxy or attend the Annual Meeting will not be considered present or represented at the Annual Meeting and will not be counted in determining the presence of a quorum. The inspectors of election appointed for the Annual Meeting will determine whether a quorum is present.

Abstentions and broker non-votes, if any, will be counted for purposes of determining whether a quorum is present for the transaction of business at the Annual Meeting. If there is no quorum, the chairperson of the Annual Meeting or the holders of a majority of shares present at the Annual Meeting or represented by proxy may adjourn the Annual Meeting to another date.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

| 4 |

What vote is required to approve each item and how are votes counted?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes.

|

Proposal |

Proposal Description |

Vote Required for Approval |

Effect of |

Effect of

Broker |

Matter | |

| 1 | Election of Directors | Directors will be elected by a plurality of the votes cast by the holders of shares present or represented by proxy and entitled to vote on the election of directors. The eight (8) nominees receiving the most “FOR” votes will be elected as directors. | No effect | No effect | Non-routine | |

| 2 | Ratification of the selection of Baker Tilly US, LLP as the Company’s independent registered public accounting firm | “FOR” votes from the holders of a majority of the voting power of the shares present in person or represented by proxy and entitled to vote on the matter. | Against | Not applicable(1) | Routine | |

| 3 | Approval of the issuance of Common Stock in connection with the Series B Proposal | “FOR” votes from the holders of a majority of the voting power of the shares present in person or represented by proxy and entitled to vote on the matter. | No effect | No effect | Non-routine | |

| 4 | Approval of the Reverse Stock Split | “FOR” votes from the holders of a majority of the voting power of the shares present in person or represented by proxy and entitled to vote on the matter. | No effect | No effect | Non-routine |

| (1) | This proposal is considered to be a “routine” matter. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent has discretionary authority to vote your shares on this proposal. |

Could other matters be decided at the Annual Meeting?

We do not know of any other matters that may be presented for action at the Annual Meeting. Should any other business come before the Annual Meeting, the persons named on the proxy will have discretionary authority to vote the shares represented by such proxies in accordance with their best judgment. If you hold shares through a broker, bank or other nominee as described above, they will not be able to vote your shares on any other business that comes before the Annual Meeting unless they receive instructions from you with respect to such matter.

What happens if the Annual Meeting is postponed or adjourned?

Your proxy may be voted at the postponed or adjourned Annual Meeting. You will still be able to change your proxy until it is voted.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K, or Form 8-K, that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What does it mean if I receive more than one set of Proxy Materials?

It means that your shares may be registered in one or more names or multiple accounts at the transfer agent or with brokers. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

| 5 |

I share the same address with another stockholder of the Company. Why has our household only received one set of proxy materials?

The rules of the Securities and Exchange Commission’s (the “SEC”) permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This practice, known as “householding,” is intended to reduce the Company’s printing and postage costs. We have delivered only one set of proxy materials to stockholders who hold their shares through a bank, broker or other holder of record and share a single address, unless we received contrary instructions from any stockholder at that address.

Who should I call if I have any additional questions?

If you are the stockholder of record for your shares, please call the Company at (844) 722-6333. If your shares are held in street name, please contact the telephone number provided on your voting instruction form or contact your broker or nominee holder directly.

| 6 |

PROPOSAL 1: ELECTION OF DIRECTORS

General

At the Annual Meeting, the stockholders will elect eight (8) directors to serve until the 2025 Annual Meeting or until their respective successors are elected and qualified. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy, including vacancies created by an increase in the number of directors, shall serve for the remainder of the term and until the director’s successor is duly elected and qualified. There are currently no vacancies on the Board.

Upon the recommendation of the Nominating and Corporate Governance Committee, our Board has nominated the eight (8) individuals listed in the table below for election as directors at the Annual Meeting. Each of the nominees listed below is currently a director of the Company. If you elect the nominees listed below, they will each hold office until the 2025 Annual Meeting and until each of their successors has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. All nominees are currently serving on our Board and have consented to being named in this Proxy Statement and to serve if elected.

If any nominee is unable or does not qualify to serve, you or your proxy may vote for another nominee proposed by the Board. If, for any reason, these nominees prove unable or unwilling to stand for election or cease to qualify to serve as directors, the Board will nominate alternates or reduce the size of the Board to eliminate the vacancies. The Board has no reason to believe that any of the nominees would prove unable to serve if elected.

Information about the Nominees

| Director | ||||||

| Nominees | Age (1) | Position(s) Held | Since | |||

| William B. Horne | 55 | Chairman of the Board | 2016 | |||

| Milton C. Ault, III | 54 | Vice Chairman of the Board | 2024 | |||

| Stephan Jackman | 48 | Chief Executive Officer and Director | 2020 | |||

| Henry Nisser | 55 | Executive Vice President, General Counsel and Director | 2020 | |||

| Mark Gustafson | 64 | Director | 2021 | |||

| Lynne F. McGrath | 69 | Director | 2021 | |||

| Andrew H. Woo | 61 | Director | 2021 | |||

| Jeffrey Oram | 56 | Director | 2021 |

| (1) | Ages as of the Record Date. |

The principal occupation, business experience and education of each nominee for election as director and each continuing and retiring director are set forth below. Unless otherwise indicated, principal occupations shown for each director have extended for five or more years.

William B. Horne has served as a director of our company since June 2016 and upon the effectiveness of our initial public offering in June 2021, Mr. Horne become our Chairman of the Board. Mr. Horne served as our Chief Financial Officer from June 2016 through December 2018. Mr. Horne has been a member of the board of directors of Ault Alliance since October 2016. In January 2018, Mr. Horne was appointed as Ault Alliance’s Chief Financial Officer until August 2020, when he resigned as its Chief Financial Officer and was appointed as its President. On January 12, 2021, Mr. Horne resigned as Ault Alliance’s President and became its Chief Executive Officer. Mr. Horne has served as a director and Chief Executive Officer of Ault Disruptive Technologies Corporation, a special purpose acquisition company (“Ault Disruptive”), since its inception in February 2021. Mr. Horne has served as a director and Chief Financial Officer of Avalanche International Corp., a publicly traded Nevada company categorized as a “voluntary filer” (not required to file periodic reports) (“Avalanche”), since June 2016. Mr. Horne has served as a director and Chief Financial Officer of Ault & Company, Inc. (“Ault & Co.”) since October 2017. He served as the Chief Financial Officer of Targeted Medical Pharma, Inc. from August 2013 to May 2019. Mr. Horne previously held the position of Chief Financial Officer in various public and private companies in the healthcare and high-tech field. Mr. Horne has a Bachelor of Arts Magna Cum Laude in Accounting from Seattle University. We believe that Mr. Horne's extensive financial and accounting experience in diversified industries and with companies involving complex transactions give him the qualifications and skills to serve as one of our directors.

| 7 |

Milton C. Ault, III has served as a director of our company since January 2024. Mr. Ault is the Company’s founder and served as Chairman and a director from inception in 2016 until the Company’s initial public offering in June 2021. Since January 2021, Mr. Ault has served as the Executive Chairman of Ault Alliance. Between December 2017 and January 2021, Mr. Ault was the Chief Executive Officer of Ault Alliance and between March 2017 and December 2017, Mr. Ault served as the Executive Chairman of Ault Alliance. Mr. Ault has served as the Chairman of the Board of Ault Disruptive since its incorporation in February 2021. Since January 2024, Mr. Ault has served as the Chairman and Chief Executive Officer of RiskOn International, Inc., an issuer listed on Nasdaq (“ROI”). Since April 2023, Mr. Ault has served as the Executive Chairman of the board of directors of the Singing Machine Company, Inc., an issuer listed on Nasdaq (“MICS”). Mr. Ault has served as Chairman and Chief Executive Officer of Ault & Co. since December 2015, and as Chairman of Avalanche since September 2014. Since January 2011, Mr. Ault has been the Vice President of Business Development for MCKEA Holdings, LLC, a family office (“MCKEA”). Mr. Ault is a seasoned business professional and entrepreneur who has spent more than twenty-seven years identifying value in various financial markets including equities, fixed income, commodities, and real estate. Throughout his career, Mr. Ault has consulted for a few publicly traded and privately held companies, providing each of them the benefit of his diversified experience, that range from development stage to seasoned businesses. We believe that Mr. Ault’s business background demonstrates he has the qualifications to serve as one of our directors.

Stephan Jackman joined our company as Chief Executive Officer in November 2018. Mr. Jackman was elected as a director in September 2020. He has played an integral role in the development of therapeutic treatments, products and programs from the research stage to market and commercialization. Mr. Jackman has demonstrated a dedicated dual focus of creating value for internal and external stakeholders while developing strategic alliances and cross-function teams to meet and exceed goals. Prior to joining our company, from October 2017 to November 2018, Mr. Jackman was the Chief Operating Officer of Ennaid Therapeutics, an emerging biopharmaceutical company focusing on cures for mosquito-borne infectious diseases such as Zika and Dengue viruses. From October 2015 to October 2017, Mr. Jackman was Chief Operating Officer of Exit 9 Technologies, a technology startup with a digital platform that connects retailers, publishers and customers. Additionally, from August 2014 to October 2015, he was an independent project and management consultant assisting startups, Fortune 500 companies and non-profits with major strategic initiatives. He has also held positions of increasing responsibility at Novartis Pharmaceuticals Corporation, L’Oréal USA, SBM Management Services and Family Intervention Services. Mr. Jackman holds a Master of Science in Management and a Bachelor of Engineering in Mechanical Engineering from Stevens Institute of Technology. We believe that Mr. Jackman’s 15 years of experience in life sciences and growth companies, day-to-day operational leadership of our company and in-depth knowledge of our drug candidates make him well qualified as a member of the Board.

Henry C.W. Nisser has served as our Executive Vice President and General Counsel on a part-time basis since May 2019. Mr. Nisser was appointed as a director in September 2020. Since May 2019, Mr. Nisser has served as the Executive Vice President and General Counsel of Ault Alliance and as one of its directors since September 2020; he became Ault Alliance’s President on January 12, 2021. Since March 2023, Mr. Nisser has served as the President, General Counsel and director of ROI. Since February 2021, Mr. Nisser has served as the President, General Counsel and a director of Ault Disruptive. Since April 2023, Mr. Nisser has served as a director of MICS. Mr. Nisser is the Executive Vice President and General Counsel of Avalanche. From December 15, 2021 through March 16, 2022, Mr. Nisser served as Chief Executive Officer and on the board of directors of TurnOnGreen, Inc. (formerly, Imperalis Holding Corp.) (“TurnOnGreen”), an OTCQB quoted company. From October 2011 through April 2019, Mr. Nisser was an associate and subsequently a partner with Sichenzia Ross Ference LLP, a law firm in New York. While with this law firm, his practice was concentrated on national and international corporate law, with a particular focus on U.S. securities compliance, public as well as private M&A, equity and debt financings and corporate governance. Mr. Nisser received his B.A. degree from Connecticut College, where he majored in International Relations and Economics. He received his LL.B. from University of Buckingham School of Law in the United Kingdom. We believe that Mr. Nisser’s extensive legal experience involving complex transactions and comprehensive knowledge of securities laws and corporate governance requirements applicable to listed companies give him the qualifications and skills to serve as one of our directors.

Mark Gustafson joined our Board of Directors and became the Chairman of the Audit Committee in June 2021. Mr. Gustafson is a Chartered Professional Accountant with over 35 years of corporate, private and public company experience. Since January 2023, Mr. Gustafson has been a director and non-executive Chairman of BrainLuxury, Inc., a private U.S. company that is developing and selling nutrients for the brain. Since April 2021, Mr. Gustafson has been the Chief Financial Officer, and since January 2022, a director, for PharmaKure Limited, a private London-based biopharmaceutical company dedicated to the treatment of neurodegenerative diseases. Between December 2021 and December 2023, Mr. Gustafson served as an independent director and Chairman of the Audit Committee of Ault Disruptive. Since June 2020, Mr. Gustafson has served as the founder and director of Alpha Helium Inc., a private Canadian-based company helium exploration company. From 2014 to 2020, he was the Chief Executive Officer of Challenger Acquisitions Limited, a London Stock Exchange listed entertainment company. From 2010 to 2012, Mr. Gustafson was the President and Chief Executive Officer of Euromax Resources Limited, a Toronto Stock Exchange listed mineral exploration company. From 2005 to 2009, he served as Chairman and Chief Executive Officer of Triangle Energy Corporation, a New York Stock Exchange listed oil and gas exploration company, from 2004 to 2006, he served as President and Chief Executive Officer of Torrent Energy Corporation, a private oil and gas company, and from 2001 to 2002, he served as a financial consultant for Samson Oil & Gas and Peavine Resources, two private oil and gas companies. From 1997 to 1999, Mr. Gustafson served as President and Chief Executive Officer of Total Energy Services Ltd., a Toronto Stock Exchange listed oilfield services company, from 1993 to 1995, he served as the Chief Financial Officer of Q/media Software Corporation, a Toronto Stock Exchange listed software company, and from 1987 to 1993, he served initially as the Chief Financial Officer and then as a Vice President in charge of two operating divisions at EnServ Corporation, a Toronto Stock Exchange listed oilfield services company. From 1981 to 1987, he served as an audit manager at Price Waterhouse in Calgary Alberta. Mr. Gustafson received his Bachelor of Business Administration from Wilfrid Laurier University. Mr. Gustafson has been a Chartered Accountant since 1983. We believe that Mr. Gustafson’s more than 35 years of corporate, private and public company operational and financial experience gives him the qualifications and skills to serve as one of our directors and as Chairman of the Audit Committee.

| 8 |

Lynne Fahey McGrath, M.P.H., Ph.D. joined our Board of Directors in June 2021. Dr. McGrath has served as a consultant to various companies in the biopharmaceutical industry, including: to the executive team of Nobias Therapeutics, Inc., a biotechnology product development company, between May 2020 and December 2021; a regulatory consultant with FoxKiser, LLC, a biotechnology consulting firm, from August 2018 to March 2020; and a regulatory consultant with Catalyst Healthcare Consulting, a biotechnology consulting firm, from 2020 to 2021. Dr. McGrath was a senior lead and Vice President of Regulatory Affairs at Regenxbio, Inc., where she headed global strategy for its portfolio of gene therapy products, from April 2015 to July 2018. Previously, she held senior positions at Novartis Corporation including Vice President, Global Head of Regulatory Affairs at Novartis Consumer Health and U.S. Head of Regulatory Affairs at Novartis Oncology from 2003 to April 2015. Dr. McGrath received a B.S. degree from the University of Connecticut, M.S. in Environmental Science from Rutgers University and M.P.H. and Ph.D. in Public Health from the University of Medicine and Dentistry of New Jersey Robert Wood Johnson Medical School. We believe that Dr. McGrath’s expertise in regulatory affairs and pharmaceutical product development across a range of therapeutic categories and her more than 30 years of experience directing worldwide approvals of more than 50 new drugs and indications makes her well qualified to serve as one of our directors.

Andrew H. Woo, M.D., Ph.D. joined our Board of Directors in June 2021. Dr. Woo is in private practice at Santa Monica Neurological Consultants and serves as an Assistant Clinical Professor of Neurology at the David Geffen School of Medicine at UCLA and Cedars-Sinai Medical Center. He also serves on the board for the Multiple Sclerosis Association of America and its Navigating MS International Steering Committee. He has been presented with UCLA clinical faculty teaching awards in 2006, 2012 and 2019 and is listed in America’s Top Physicians by the Consumer Research Council of America and Castle Connolly America’s Top Doctors 2006, 2007, 2010-2021, Southern California Super Doctors since 2008, and Los Angeles Magazine Top Doctors. He is an invited speaker at the Muntada International Symposium in Abu Dhabi. Dr. Woo received his B.A. from Cornell University and completed his M.D. and Ph.D. in Neuroimmunology in the Department of Molecular and Cell Biology at Brown University. He completed his medicine internship at Weil-Cornell Presbyterian Hospital/Cornell Medical Center in New York, his neurology residency at UCLA, and his fellowship in neurophysiology at Harbor-UCLA. We believe that Dr. Woo’s extensive medical experience gives him the qualifications and skills and relevant insight to serve as one of our directors.

Jeffrey Oram joined our Board of Directors in June 2021. Mr. Oram is a business professional with more than 25 years of corporate, private and institutional investment experience. Mr. Oram has spent the last 13 years in the institutional real estate capital markets. Since 2016, he has been a Principal at Godby Realtors, a private real estate investment and brokerage firm. From 2010 to 2018, Mr. Oram served as an Executive Member of the New Jersey State Investment Council, which oversees the investment of the State of New Jersey’s pension fund. From 2011 to 2016, he served as Executive Managing Director at Colliers International, from 2009 to 2011 he served as Director at Marcus and Millichap, and from 2003 to 2009, served as First Vice President at CB Richard Ellis. Mr. Oram received a Bachelor of Science degree in Biology from Princeton University. We believe that Mr. Oram’s 25 years of corporate, private and institutional investment experience gives him the qualifications and skills to serve as one of our directors.

Involvement in Certain Legal Proceedings

To our knowledge, and except as disclosed below, none of our current directors has, during the past ten years:

| ● | been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| ● | had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he or she was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; |

| ● | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his or her involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; |

| 9 |

| ● | been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; * |

| ● | been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| ● | been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

* Please see the press release issued by Ault Alliance, Inc. (“Ault Alliance”) on August 15, 2023.

Except as set forth in our discussion below in “Certain Relationships and Related Transactions,” none of our directors or executive officers has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

Family Relationships

None.

Board Independence

Rule 5605 of the Nasdaq Listing Rules requires that independent directors compose a majority of a listed company’s board of directors. In addition, the Nasdaq Listing Rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent and that audit committee members also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act. Under Nasdaq Listing Rule 5605(a)(2), a director will only qualify as an “independent director” if, in the opinion of our Board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. To be considered independent for purposes of Rule 10A-3 under the Exchange Act, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee: (i) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the company or any of its subsidiaries; or (ii) be an affiliated person of the company or any of its subsidiaries. In addition to satisfying general independence requirements under the Nasdaq Listing Rules, members of the compensation committee must also satisfy additional independence requirements set forth in Rule 10C-1 under the Exchange Act and Nasdaq Listing Rule 5605(d)(2). Pursuant to Rule 10C-1 under the Exchange Act and Nasdaq Listing Rule 5605(d)(2), in affirmatively determining the independence of a member of a compensation committee of a listed company, the board of directors must consider all factors specifically relevant to determining whether that member has a relationship with the company that is material to that member’s ability to be independent from management in connection with the duties of a compensation committee member, including: (a) the source of compensation of such member, including any consulting, advisory or other compensatory fee paid by the Company to such member; and (b) whether such member is affiliated with the Company, a subsidiary of the Company or an affiliate of a subsidiary of the Company.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, our Board has affirmatively determined that all our directors, except Milton C. Ault, III, who serves as our Vice Chairman of the Board, Stephan Jackman, who serves as our Chief Executive Officer, and Henry Nisser, who serves as our Executive Vice President and General Counsel, are independent directors within the meaning of the applicable Nasdaq Listing Rules and SEC rules. In making this determination, our Board has determined, upon the recommendation of our Nominating and Corporate Governance Committee, that none of these directors has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and is independent within the meaning of the director independence standards established by the SEC and the Nasdaq Listing Rules. The Board also determined that each member of our Audit, Compensation and Nominating and Corporate Governance Committees satisfies the independence standards for such committees established by the SEC and the Nasdaq Listing Rules, as applicable.

| 10 |

At least annually, our Board will evaluate all relationships between us and each director considering relevant facts and circumstances for the purposes of determining whether a material relationship exists that might signal a potential conflict of interest or otherwise interfere with such director’s ability to satisfy his or her responsibilities as an independent director. Based on this evaluation, our Board will make an annual determination of whether each director is independent within the meaning of Nasdaq and the SEC independence standards.

Board Meetings and Attendance

Our Board held five (5) meetings during the fiscal year ended April 30, 2023, the Audit Committee held five (5) meetings, the Compensation Committee held six (6) meetings and the Nominating and Corporate Governance Committee did not hold a meeting, and the Board and various committees also took other actions by unanimous written consent. Each of the incumbent directors attended at least 75% of the meetings of the Board or committees of the Board on which he or she served during the fiscal year ended April 30, 2023 (in each case, which were held during the period for which he or she was a director and/or a member of the applicable committee). We encourage, but do not require, our Board members to attend the Annual Meeting.

Board Committees

Our Board has established three (3) standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee, each of which is composed solely of independent directors and is described more fully below. Each committee operates pursuant to a written charter and each committee reviews and assesses the adequacy of its charter and submits its charter to the Board for approval. The charters for each committee are all available on our website, www.alzamend.com. The inclusion of our website address here and elsewhere in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement. Our Board may establish other committees from time to time.

The following table provides membership information for each committee:

| Name | Audit Committee | Nominating and Corporate Governance Committee |

Compensation Committee | ||

| Mark Gustafson | ** + | * | |||

| Lynne F. McGrath | * | ** | |||

| Andrew H. Woo | * | * | |||

| Jeffrey Oram | * | ** | * |

* Member of Committee

** Chairman of Committee

+ “Audit committee financial expert” as defined in SEC regulations.

Below is a description of each committee of the Board.

Audit Committee

Messrs. Gustafson, Woo and Oram currently serve as members of the Audit Committee, with Mr. Gustafson serving as chair of the committee. Our Board has determined that each current member of the Audit Committee meets the independence requirements of Rule 10A-3 under the Exchange Act and the applicable listing standards of Nasdaq. Our Board determined that Mr. Gustafson is an “audit committee financial expert,” both within the meaning of the SEC regulations and applicable listing standards of Nasdaq. The report of the Audit Committee is included in this Proxy Statement under “Report of the Audit Committee.” The functions of our Audit Committee include, among other things:

| • | appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm; | |

| • | approving audit and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm; |

| 11 |

| • | reviewing the audit plan with the independent registered public accounting firm and members of management responsible for preparing our financial statements; | |

| • | reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures as well as critical accounting policies and practices used by us; | |

| • | reviewing the adequacy of our internal control over financial reporting; | |

| • | establishing policies and procedures for the receipt and retention of accounting-related complaints and concerns; | |

| • | recommending, based upon the Audit Committee’s review and discussions with management and the independent registered public accounting firm, whether our audited financial statements shall be included in our Annual Report on Form 10-K; | |

| • | monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters; | |

| • | preparing the Audit Committee report required by the rules of the SEC to be included in our annual proxy statement; and | |

| • | reviewing all related party transactions for potential conflict of interest situations and approving all such transactions. |

Compensation Committee

Ms. McGrath and Messrs. Gustafson and Oram currently serve as members of the Compensation Committee, with Ms. McGrath serving as chair of the committee. Our Board has determined that each current member of the Compensation Committee is “independent” as defined under the applicable listing standards of Nasdaq. The functions of our Compensation Committee include, among other things:

| • | annually reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer; | |

| • | evaluating the performance of our Chief Executive Officer considering such corporate goals and objectives and determining the compensation of our Chief Executive Officer; | |

| • | reviewing and approving the compensation of our other executive officers and certain other members of senior management; | |

| • | appointing, compensating and overseeing the work of any compensation consultant, legal counsel or other advisor retained by the Compensation Committee; | |

| • | conducting the independence assessment outlined in Nasdaq rules with respect to any compensation consultant, legal counsel or other advisor retained by the Compensation Committee; | |

| • | annually reviewing and reassessing the adequacy of the committee charter in its compliance with the listing requirements of Nasdaq; | |

| • | reviewing and establishing our overall management compensation, philosophy and policy; | |

| • | overseeing and administering our compensation and similar plans; | |

| • | reviewing and approving our policies and procedures for the grant of equity-based awards; | |

| • | reviewing and making recommendations to the Board with respect to director compensation; |

| 12 |

| • | reviewing and discussing with management the compensation discussion and analysis to be included in our annual proxy statement or Annual Report on Form 10-K; and | |

| • | reviewing and discussing with the Board corporate succession plans for the Chief Executive Officer and other key officers. |

In fulfilling its responsibilities, the Compensation Committee may delegate any or all its responsibilities to a subcommittee of the Compensation Committee, but only to the extent consistent with our amended and restated Certificate, our amended and restated bylaws (“Bylaws”), our Corporate Governance Guidelines, Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) (as applicable), the Nasdaq Listing Rules and other applicable law. In addition, pursuant to its charter, the Compensation Committee has the sole authority, in its sole discretion, to retain compensation consultants to assist the Compensation Committee with its functions, including any studies or investigations. The Compensation Committee engaged Peter R. Johnson & Co., Inc., an independent executive compensation consultant, during the year ended April 30, 2023 conduct an assessment of the compensation program, practices and current pay and reward levels of the Company’s chief executive officer.

Nominating and Corporate Governance Committee

Ms. McGrath and Messrs. Oram and Woo currently serve as members of the Nominating and Corporate Governance Committee, with Mr. Oram serving as chair of the committee. Our Board has determined that each member of the Nominating and Corporate Governance Committee is “independent” as defined under the applicable listing standards of Nasdaq. The functions of our Nominating and Corporate Governance Committee include, among other things:

| • | developing and recommending to the Board criteria for membership of the Board and committees; | |

| • | establishing procedures for identifying and evaluating Board candidates, including candidates recommended by stockholders; | |

| • | identifying individuals qualified to become members of the Board; | |

| • | recommending to the Board the persons to be nominated for election as directors and to each of the committees of the Board; | |

| • | developing and recommending to the Board a set of corporate governance guidelines; and | |

| • | overseeing the evaluation of the Board and management. |

Identifying and Evaluating Director Nominees

Our Board is responsible for selecting its own members. The Board delegates the selection and nomination process to the Nominating and Corporate Governance Committee, with the expectation that other members of the Board, and of management, will be requested to take part in the process as appropriate.

Generally, our Nominating and Corporate Governance Committee identifies candidates for director nominees in consultation with management, using search firms or other advisors, through the recommendations submitted by stockholders or through such other methods as the Nominating and Corporate Governance Committee deems to be helpful to identify candidates. Once candidates have been identified, our Nominating and Corporate Governance Committee confirms that the candidates meet all the minimum qualifications for director nominees established by the Nominating and Corporate Governance Committee. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to us during their tenure, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. The Nominating and Corporate Governance Committee may gather information about the candidates through interviews, detailed questionnaires, background checks or any other means that the Nominating and Corporate Governance Committee deems to be appropriate in the evaluation process. The Nominating and Corporate Governance Committee then meets as a group to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and considering the overall composition and needs of our Board. Based on the results of the evaluation process, the Nominating and Corporate Governance Committee recommends candidates for the Board’s approval as director nominees for election to the Board. The Nominating and Corporate Governance Committee will consider candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the way it evaluates candidates based on whether the candidate was recommended by a stockholder.

| 13 |

In accordance with our Bylaws and the charter of our Nominating and Corporate Governance Committee, nominations and recommendations of individuals for election to our Board at an annual meeting of stockholders may be made by any stockholder of record entitled to vote for the election of directors at such meeting who provides timely notice in writing to our Secretary at our principal executive offices. To be timely, we must receive the notice not less than 90 days nor more than 120 days prior to the first anniversary of the date of the prior year’s annual meeting; provided, however, that in the event that the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, we must receive the stockholder’s notice (i) no earlier than the close of business on the 120th day prior to the proposed date of the annual meeting and (ii) no later than the close of business on the later of the 90th day prior to the annual meeting or the 10th day following the day on which we first make a public announcement of the date of the annual meeting. The stockholder’s written notice must contain specific information required in Section 2.15 of our Bylaws. For additional information about our director nomination requirements, please see our Bylaws.

Minimum Qualifications

Our Nominating and Corporate Governance Committee considers, among other things, the following qualifications, skills and attributes when recommending candidates for the Board’s selection as director nominees for the Board and as candidates for appointment to the Board’s committees: a director nominee shall have the highest personal and professional integrity, shall have demonstrated exceptional ability and judgment, and shall be most effective, in conjunction with the other director nominees to the Board, in collectively serving the long-term interests of the stockholders.

In evaluating proposed director candidates, our Nominating and Corporate Governance Committee may consider, in addition to the minimum qualifications and other criteria for board membership approved by the Board from time to time, all facts and circumstances that it deems appropriate or advisable, including, among other things, diversity considerations, the skills of the proposed director candidate, his or her depth and breadth of professional experience or other background characteristics, his or her independence (if applicable) and the needs of the Board. We have no formal policy regarding board diversity, but believe that our Board, taken as a whole, should embody a diverse set of skills, experiences and backgrounds. In this regard, the committee also takes into consideration the diversity (for example, with respect to gender, race and national origin) of our board members. The committee does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors. Our committee’s priority in selecting board members is the identification of persons who will further the interests of our company through his or her established record of professional accomplishment, the ability to contribute positively to the collaborative culture among board members, and professional and personal experiences and expertise relevant to our growth strategy.

Certain Board Arrangements

In May 2021, the Board and Mr. Ault, our Founder and Chairman Emeritus, agreed to certain arrangements with regard to our Board composition and other matters. Contemporaneously with the consummation of the initial public offering, and in consideration for (i) the conversion of 750 shares of our series A convertible preferred stock beneficially owned by Mr. Ault through Ault Life Sciences, Inc. (“ALSI”) into 1,000,000 shares of Common Stock, (ii) the extension of the maturity date of the promissory note in the original principal amount of $15,000,000 (the “ALSF Note”) issued to us by Ault Life Sciences Fund, LLC (“ALSF”) to December 31, 2023, and (iii) the resignation of Mr. Ault as a director and executive officer of our company, the Board agreed that William B. Horne be named our Chairman of the Board and remain in that position for so long as Mr. Ault beneficially owns no less than 5% of the outstanding shares of Common Stock (for which Mr. Horne will be paid $50,000 per year for his services), and Mr. Nisser remains a member of our Board of Directors for so long as Mr. Ault beneficially owns no less than 5% of the outstanding shares of Common Stock (for no additional remuneration). Additionally, Mr. Ault will hold the position of Founder and Chairman Emeritus and, as such, have the right to nominate an observer to our Board for a period of five years after the closing date of the initial public offering. Immediately following the closing of the initial public offering in June 2021, we entered into a five-year consulting agreement with Mr. Ault under which he will provide strategic advisory and consulting services to us in consideration for annual fees of $50,000. Upon Mr. Ault’s reappointment to the Board in January 2024, the consulting agreement was terminated.

| 14 |

Board Diversity

As a Nasdaq listed company, we are required to disclose board level diversity statistics. The following tables set forth the relevant information of the Board as of March __, 2024 and March 31, 2023, respectively.

| Board Diversity Matrix as of March __, 2024 | ||||

| Total Number of Directors | 8 | |||

| Female | Male | Non-Binary | Did Not Disclose Gender | |

| Part I: Gender Identity | ||||

| Directors | 1 | 7 | – | – |

| Part II: Demographic Background | ||||

| African American or Black | – | 1 | – | – |

| Alaskan Native or Native American | – | – | – | – |

| Asian | – | 1 | – | – |

| Hispanic or Latinx | – | – | – | – |

| Native Hawaiian or Pacific Islander | – | – | – | – |

| White | 1 | 5 | – | – |

| Two or More Races or Ethnicities | – | – | – | – |

| LGBTQ+ | 1 | |||

| Did Not Disclose Demographic Background | – | |||

| Board Diversity Matrix as of March 31, 2023 | ||||

| Total Number of Directors | 7 | |||

| Female | Male | Non-Binary | Did Not Disclose Gender | |

| Part I: Gender Identity | ||||

| Directors | 1 | 6 | – | – |

| Part II: Demographic Background | ||||

| African American or Black | – | 1 | – | – |

| Alaskan Native or Native American | – | – | – | – |

| Asian | – | 1 | – | – |

| Hispanic or Latinx | – | – | – | – |

| Native Hawaiian or Pacific Islander | – | – | – | – |

| White | 1 | 4 | – | – |

| Two or More Races or Ethnicities | – | – | – | – |

| LGBTQ+ | 1 | |||

| Did Not Disclose Demographic Background | – | |||

Leadership Structure and Risk Oversight

Our Board is currently chaired by Mr. Horne. Mr. Horne has been a director since June 2016 and served as our Chief Financial Officer from June 2016 until December 2018. Given Mr. Horne’s extensive history with and knowledge of our company, we believe his role as our Chairman facilitates a regular flow of information between the Board and management and ensures that they both act with a common purpose.

One of the key functions of our Board is informed oversight of our risk management process. Our Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various standing committees of our Board that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for us. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

| 15 |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who beneficially own more than 10% of our Common Stock to file initial reports of ownership and changes in ownership of our Common Stock and other equity securities with the SEC. These individuals are required by the regulations of the SEC to furnish us with copies of all Section 16(a) forms they file. Based solely on a review of the copies of the forms furnished to us, and written representations from reporting persons, we believe that all filing requirements applicable to our officers, directors and 10% beneficial owners were complied with during our fiscal year ended April 30, 2023, except for one late Form 4 by a 10% beneficial owner.

Code of Business Conduct and Ethics

Our Board has adopted a written code of business conduct and ethics, revised effective May 25, 2021, that applies to our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer or controller, or persons performing similar functions (the “Code of Conduct and Ethics”). In addition, on May 25, 2021, we adopted a Code of Ethics for our Chief Executive Officer and our Senior Financial Officers (the “Code of Ethics”). We have posted on our website a current copy of both codes and all disclosures that are required by law in regard to any amendments to, or waivers from, any provision of the Code of Conduct and Ethics.

Stockholder Communications with Our Board of Directors