Filed pursuant to Rule 424(b)(5)

Registration No. 333-273610

Prospectus Supplement

(To Prospectus dated August 10, 2023)

ALZAMEND NEURO, INC.

50 Shares of Series A Convertible Preferred Stock

Up to 1,375,310 Shares of Common Stock Issuable upon Conversion of Series A Convertible Preferred Stock

We are offering 50 shares of Series A convertible preferred stock (the “Series A Preferred”) pursuant to this prospectus supplement, the accompanying prospectus, and a securities purchase agreement entered into on May 8, 2024 (the “Purchase Agreement”), between the Company and an institutional investor thereto (the “Investor”). Each share of Series A Preferred has a stated value of $10,000 per share (the “Stated Value”) and is convertible into such number of shares of our common stock, par value $0.0001 per share (our “Common Stock”) equal to the Stated Value divided by the Conversion Price (as defined below). The terms and conditions of the Series A Preferred are set forth in the certificate of designations of rights and preferences of the Series A Preferred (the “Series A COD”).

The “Conversion Price” of the Series A Preferred is equal to (y) the greater of (i) $0.25 per share (the “Floor Price”), which Floor Price shall be adjusted for stock dividends, stock splits, stock combinations and other similar transactions and (ii) the lesser of (A) $1.50 and (B) 80% of the lowest closing price of our Common Stock during the three trading days immediately prior to the date of conversion into shares of Common Stock.

We are also offering pursuant to this prospectus supplement the shares of Common Stock issuable upon conversion of the Series A Preferred (the “Conversion Shares”). However, pursuant to the rules of the Nasdaq Capital Market, where our Common Stock is listed, we may not issue more than a maximum of 19.99% of our shares of Common Stock issued and outstanding on the date of execution of the Purchase Agreement absent stockholder approval, which we have agreed with the Investor to seek but has not been obtained. As a result, currently the maximum number of Conversion Shares we may issue to the Investor under this prospectus supplement is 1,375,310 (the “Nasdaq Limit”).

In a concurrent private placement (the “Concurrent Private Placement”) pursuant to the Purchase Agreement, we are also selling to the Investor in this offering, up to 2,450 additional shares of Series A Preferred (the “Private Series A Preferred”) and warrants (the “Warrants”) to purchase up to 20 million shares of our Common Stock in several tranches. The Warrants will have an initial exercise price of $1.25 per share and will be immediately exercisable for a term of five years from issuance. The Private Series A Preferred, the shares of our Common Stock issuable upon conversion of the Private Series A Preferred, the Warrants and the shares of our Common Stock issuable upon exercise of the Warrants are not being registered under the Securities Act of 1933, as amended (the “Securities Act”), and are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder.

We will not receive any proceeds from the issuance of Conversion Shares upon conversion of the Series A Preferred.

Our Common Stock is listed on The Nasdaq Capital Market under the symbol “ALZN”. The last sale price of our Common Stock on May 9, 2024, as reported by The Nasdaq Capital Market, was $0.5994 per share. There is no established public trading market for the Series A Preferred and we do not expect a market to develop. Without an active trading market, the liquidity of the Series A Preferred will be limited. In addition, we do not intend to have the Series A Preferred admitted to trading on The Nasdaq Capital Market or listed on any other national securities exchange or any other trading system.

As of May 10, 2024, the aggregate market value of our outstanding Common Stock held by non-affiliates, or the public float, was $5,813,966, which was calculated based on 4,844,972 shares of our outstanding Common Stock held by non-affiliates at a price of $1.20 per share, the closing price of our Common Stock on March 11, 2024. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell shares with a value of more than one-third of the aggregate market value of our Common Stock held by non-affiliates in any 12-month period, or $1,937,989, so long as the aggregate market value of our Common Stock held by non-affiliates is less than $75,000,000. During the prior 12-months as of the date of this prospectus supplement, we have sold shares of our Common Stock in the aggregate amount of $1,291,837, all of which sales were made pursuant to General Instruction I.B.6 of Form S-3, leaving $646,152 to be sold under this prospectus supplement.

Delivery of the Series A Preferred offered hereby is expected to be made on or about May 10, 2024, subject to satisfaction of customary closing conditions.

We may amend or supplement this prospectus supplement from time to time by filing amendments or supplements as required. You should read the entire prospectus supplement and any amendments or supplements carefully before you make your investment decision.

All share and per share amounts presented in this prospectus supplement (but not the Prospectus dated August 10, 2023) have been retroactively adjusted to reflect the 1-for-15 reverse split of the Company’s Common Stock effective October 31, 2023.

An investment in our Common Stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained herein on page S-6 and on page 10 of the accompanying prospectus. You should read the entire prospectus supplement carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is May 10, 2024.

TABLE OF CONTENTS

Prospectus Supplement

|

Page | ||

| About this Prospectus Supplement | ii | |

| Disclosure Regarding Forward-Looking Statements | ii | |

| About the Company | S-1 | |

| The Offering | S-4 | |

| Risk Factors | S-6 | |

| Use of Proceeds | S-9 | |

| Description of the Securities we are Offering | S-10 | |

| Private Placement Transaction | S-12 | |

| Plan of Distribution | S-14 | |

| Legal Matters | S-15 | |

| Experts | S-15 | |

| Where You Can Find More Information | S-15 | |

| Incorporation of Documents by Reference | S-16 |

Prospectus

|

Page | ||

| About this Prospectus | 1 | |

| Disclosure Regarding Forward-Looking Statements | 2 | |

| Prospectus Summary | 3 | |

| Risk Factors | 11 | |

| Use of Proceeds | 12 | |

| Plan of Distribution | 13 | |

| Description of Securities We May Offer Capital Stock | 16 | |

| Description of Capital Stock | 16 | |

| Description of Warrants | 17 | |

| Description of Rights | 19 | |

| Description of Units | 19 | |

| Legal Matters | 20 | |

| Experts | 20 | |

| Where you can find more Information | 20 | |

| Incorporation of Documents by Reference | 21 |

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. We have not authorized anyone else to provide you with additional or different information. We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. You should not assume that the information in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the date on the front of those documents or that any document incorporated by reference is accurate as of any date other than its filing date.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus supplement and the accompanying prospectus applicable to that jurisdiction.

| i |

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC” or the “Commission”).

You should read this prospectus and the information and documents incorporated by reference carefully. Such documents contain important information you should consider when making your investment decision. See “Where You Can Find More Information” and “Incorporation of Documents by Reference” in this prospectus supplement.

This prospectus supplement may be supplemented from time to time to add, to update or change information in this prospectus supplement. Any statement contained in this prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus supplement only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus supplement. You should rely only on the information contained or incorporated by reference in this prospectus supplement, any other applicable prospectus supplement or any related free writing prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus supplement, any other applicable prospectus supplement or any related free writing prospectus. This prospectus supplement is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement or any other prospectus supplement, as well as information we have filed with the SEC that is incorporated by reference, is accurate as of the date on the front of those documents only, regardless of the time of delivery of this prospectus supplement or any other applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus supplement contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus supplement is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

For investors outside the United States: Neither we nor any underwriter has done anything that would permit this offering or possession or distribution of this prospectus supplement in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus supplement.

Unless otherwise stated or the context requires otherwise, references to “Alzamend,” the “Company,” “we,” “us” or “our” are to Alzamend Neuro, Inc., a Delaware corporation, and its subsidiaries.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference in it contain forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Securities Act of 1933 and the Securities Exchange Act of 1934. All statements other than statements of historical facts are statements that could be deemed forward-looking statements. These statements are based on our expectations, beliefs, forecasts, intentions and future strategies and are signified by the words “expects,” “anticipates,” “intends,” “believes” or similar language. In addition, any statements that refer to projections of our future financial performance, our anticipated growth, trends in our business and other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict, including those identified above, under “Risk Factors” and elsewhere in this prospectus. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. All forward-looking statements included in this prospectus are based on information available to us on the date of this prospectus and speak only as of the date hereof.

We disclaim any current intention to update our “forward-looking statements,” and the estimates and assumptions within them, at any time or for any reason. In particular, the following factors, among others, could cause actual results to differ materially from those described in the “forward-looking statements”:

| • | our need for substantial additional funding to finance our operations and complete development to seek FDA approval for AL001 and ALZN002 before commercialization; |

| • | our ability to effectively execute our business strategy; |

| ii |

| • | our ability to manage our expansion, growth and operating expenses; |

| • | our ability to evaluate and measure our business, prospects and performance metrics; |

| • | our ability to compete and succeed in a highly competitive and evolving industry; |

| • | our ability to respond and adapt to changes in technology and customer behavior; |

| • | our ability to protect our intellectual property and to develop, maintain and enhance a strong brand; |

| • | our significant losses since inception and anticipation that we will continue to incur significant losses for the foreseeable future; |

| • | our reliance on licenses from a third party regarding our rights and development of AL001 and ALZN002; |

| • | our development of AL001 and ALZN002 never leading to a marketable product; |

| • | our product candidates not qualifying for expedited development, or if they do, not actually leading to a faster development or regulatory review or approval process; |

| • | our approach to targeting beta-amyloid plaque via ALZN002 being based on a novel therapeutic approach; and |

| • | the risk factors included in our most recent filings with the SEC, including, but not limited to, our Forms 10-K and 10-Q, which are incorporated by reference herein. |

| iii |

ABOUT THE COMPANY

This summary highlights selected information contained in other parts of this prospectus. Because it is a summary, it does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should read the entire prospectus carefully, including the information set forth under the heading “Risk Factors.”

Company Overview

We were incorporated on February 26, 2016, as Alzamend Neuro, Inc. under the laws of the State of Delaware. We were formed to acquire and commercialize patented intellectual property and know-how to prevent, treat and potentially cure the crippling and deadly Alzheimer’s. With our two product candidates, we aim to bring treatment or cures not only for Alzheimer’s, but also, bipolar disorder (“BD”), major depressive disorder (“MDD”) and post-traumatic stress disorder (“PTSD”). Existing Alzheimer’s treatments only temporarily relieve symptoms but do not, to our knowledge, slow or halt the underlying worsening of the disease. We have developed a novel approach to combat Alzheimer’s through immunotherapy.

Plan of Operations

We intend to develop and commercialize therapeutics that are better than existing treatments and have the potential to significantly improve the lives of individuals afflicted by Alzheimer’s, BD, MDD and PTSD. To achieve these goals, we are pursuing the following key business strategies:

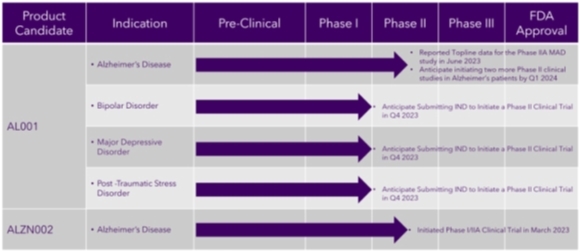

| · | Advance clinical development of AL001 for Alzheimer’s, BD, MDD and PTSD treatment; |

| · | Advance clinical development of ALZN002 for Alzheimer’s treatment; |

| · | Expand our pipeline of pharmaceuticals to include additional indications for AL001 and delivery methods; |

| · | Focus on translational and functional endpoints to efficiently develop product candidates; and |

| · | Optimize the value of AL001 and ALZN002 in major markets. |

Our pipeline consists of two novel therapeutic drug candidates:

| · | AL001 - A patented ionic cocrystal technology delivering a therapeutic combination of lithium, salicylate and proline through three royalty-bearing exclusive worldwide licenses from the University of South Florida Research Foundation, Inc., as licensor (the “Licensor”); and |

| · | ALZN002 - A patented method using a mutant peptide sensitized cell as a cell-based therapeutic vaccine that seeks to restore the ability of a patient’s immunological system to combat Alzheimer’s through a royalty-bearing exclusive worldwide license from the Licensor. |

Our most advanced product candidate (lead product) licensed and in clinical development in humans is AL001, an ionic cocrystal of lithium for the treatment of Alzheimer’s, BD, MDD and PTSD. Based on our preclinical data involving mice models, AL001 treatment prevented cognitive deficits, depression and irritability and is superior in improving associative learning and memory and irritability compared with lithium carbonate treatments, supporting the potential of this lithium formulation for the treatment of Alzheimer’s, BD, MDD and PTSD in humans. Lithium has been marketed for more than 35 years and human toxicology regarding lithium use has been well characterized, potentially mitigating the regulatory burden for safety data.

On May 5, 2022, we initiated a multiple-dose, steady-state, double-blind, ascending dose safety, tolerability, pharmacokinetic clinical trial of AL001 in patients with mild to moderate Alzheimer’s and healthy subjects. We completed the Phase IIA clinical trial patient dosing in March 2023 and announced positive topline data in June 2023.

We announced that we successfully identified a maximum tolerated dose (“MTD”) for development of AL001 from a multiple-ascending dose study as assessed by an independent safety review committee. This dose, providing lithium at a lithium carbonate equivalent dose of 240 mg 3-times daily (“TID”), is designed to be unlikely to require lithium therapeutic drug monitoring (“TDM”). Also, this MTD is risk mitigated for the purpose of treating fragile populations, such as Alzheimer’s patients.

| S-1 |

Lithium is a commonly prescribed drug for manic episodes in BD type 1 as well as maintenance therapy of BD in patients with a history of manic episodes. Lithium is also prescribed off-label for MDD, BD and treatment of PTSD, among other disorders. Lithium was the first mood stabilizer approved by the U.S. Food and Drug Administration (“FDA”) and is still a first-line treatment option (considered the “gold standard”) but is underutilized perhaps because of the need for TDM. Lithium was the first drug that required TDM by regulatory authorities in product labelling because the effective and safe range of therapeutic drug blood concentrations is narrow and well defined for treatment of BD when using lithium salts. Excursions above this range can be toxic, and below can impair effectiveness.

Based on the results from our Phase IIA MAD study, we plan to initiate two safety and efficacy clinical trials in subjects with mild to moderate dementia of the Alzheimer’s type. Additionally, we are investigating the potential of AL001 for patients suffering from BD, MDD and PTSD, and submitted Investigational New Drug (“IND”) applications to the FDA for these indications. The IND for BD was filed in August 2023 and we received a “study may proceed” letter from the FDA in September 2023. The IND for MDD was filed in October 2023 and we received a “study may proceed” letter from the FDA in November 2023. The IND for PTSD was filed in November 2023 and we received a “study may proceed” letter from the FDA in December 2023. We intend to initiate clinical trials at the MTD to determine relative increased lithium levels in the brain compared to a marketed lithium salt for BD, MDD and PTSD, based on published mouse studies that predict that lithium can be given at lower doses for equivalent therapeutic benefit when treating with AL001. For example, the goal is to replace a 300 mg TID lithium carbonate dose for treatment of BD with a 240 mg TID AL001 lithium equivalent, which represents a daily decrease of 20% of lithium given to a patient. We anticipate beginning Phase II studies for the additional indications after we have obtained the necessary financing for the trials and payment to Phase IIA MAD study vendor for the final reports of that study.

We submitted a pre-IND meeting request for ALZN002 and supporting briefing documents to the Center for Biological Evaluation and Research of the FDA on July 30, 2021. We received a written response relating to the pre-IND from the FDA providing a path for Alzamend’s planned clinical development of ALZN002 on September 30, 2021. The FDA agreed to allow Alzamend to submit an IND to conduct a combined Phase I/II study.

On September 28, 2022, we submitted an IND application to the FDA for ALZN002 and received a “study may proceed” letter on October 31, 2022. The product candidate is an immunotherapy vaccine designed to treat mild to moderate dementia of the Alzheimer’s type. ALZN002 is a proprietary “active” immunotherapy product, which means it is produced by each patient’s immune system. It consists of autologous DCs that are activated white blood cells taken from each individual patient so that they can be engineered outside of the body to attack Alzheimer’s-related amyloid-beta proteins. These DCs are pulsed with a novel amyloid-beta peptide (E22W) designed to bolster the ability of the patient’s immune system to combat Alzheimer’s; the goal being to foster tolerance to treatment for safety purposes while stimulating the immune system to reduce the brain’s beta-amyloid protein burden, resulting in reduced Alzheimer’s signs and symptoms. Compared to passive immunization treatment approaches that use foreign blood products (such as monoclonal antibodies), active immunization with ALZN002 is anticipated to offer a more robust and long-lasting effect on the clearance of amyloid. This could provide a safer approach due to its reliance on autologous immune components, using each individual patient’s own white blood cells rather than foreign cells and/or blood products.

On April 3, 2023, we announced the initiation of a Phase I/IIA clinical trial for ALZN002 to treat mild to moderate dementia of the Alzheimer’s type. The purpose of this trial is to assess the safety, tolerability, and efficacy of multiple ascending doses of ALZN002 compared with that of placebo in 20-30 subjects with mild to moderate morbidity. We expect this trial to last for up to five years. The primary goal of this clinical trial is to determine an appropriate dose of ALZN002 for treatment of patients with Alzheimer’s in a larger Phase IIB efficacy and safety clinical trial, which Alzamend expects to initiate within three months of receiving data from the initial trial. On February 13, 2024, we received notice from the company we engaged as our contract research organization (“CRO”), Biorasi, LLC. (“Biorasi”) that Biorasi was terminating our contract with them. We are currently pursuing the engagement of a replacement CRO.

The continuation of our current plan of operations with respect to initiating and conducting the series of human clinical trials for each of our therapeutics requires us to raise additional capital to fund our operations.

Because our working capital requirements depend upon numerous factors, including the progress of our preclinical and clinical testing, timing and cost of obtaining regulatory approvals, changes in levels of resources that we devote to the development of manufacturing and marketing capabilities, competitive and technological advances, status of competitors, and our ability to establish collaborative arrangements with other organizations, we will require additional financing to fund future operations.

Recent Developments

Nasdaq Listing

Deficiency Letter from Nasdaq – Market Value

On September 26, 2023, we received a notice from the staff of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, for the previous 30 consecutive business days, the minimum Market Value of Listed Securities (“MVLS”) for our Common Stock was below the $35 million minimum MVLS requirement for continued listing on The Nasdaq Capital Market under Nasdaq Listing Rule 5550(b)(2) (the “MVLS Rule”). In accordance with Nasdaq Listing Rule 5810(c)(3)(C), we had 180 calendar days, or until March 25, 2024, to regain compliance with the MVLS Rule. To regain compliance with the MVLS Rule, the MVLS for our Common Stock must close at $35 million or more for a minimum of 10 consecutive business days at any time during this 180-day period.

| S-2 |

On March 26, 2024, we were notified by Nasdaq that we had not regained compliance with the MVLS Rule. Accordingly, unless the Company requested an appeal of this determination, the Nasdaq staff had determined that our Common Stock would be delisted from Nasdaq. We appealed the staff’s determination to delist our Common Stock to a Hearings Panel (the “Panel”). The Panel heard our appeal on May 9, 2024, but no decision has been made by the Panel to date.

Deficiency Letter from Nasdaq – Bid Price

On February 1, 2024, we received a notice in the form of a letter (“Deficiency Letter”) from the Listing Qualifications Staff of the Nasdaq stating that we were not in compliance with Nasdaq Listing Rule 5550(a)(2) because the bid price for the Common Stock had closed below $1.00 per share for the previous 30 consecutive business days. In accordance with Nasdaq listing rule 5810(c)(3)(A), we have 180 calendar days, or until July 30, 2024, to regain compliance. The Deficiency Letter states that to regain compliance, the bid price for the Common Stock must close at $1.00 per share or more (the “Minimum Bid Price”) for a minimum of 10 consecutive business days during the compliance period ending July 30, 2024. In the event that we do not regain compliance within this 180-day period, we may be eligible to seek an additional compliance period of 180 calendar days if we meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the Minimum Bid Price, and provides written notice to Nasdaq of its intent to cure the deficiency during this second compliance period, by effecting a reverse stock split, if necessary. However, if it appears to the Nasdaq Staff that we will not be able to cure the deficiency, or if we are otherwise not eligible, Nasdaq will provide notice to us that our Common Stock will be subject to delisting. At that time, we may appeal any such delisting determination to a Nasdaq hearings panel.

Corporate Information

Our principal executive offices are located at 3480 Peachtree Road NE, Second Floor, Suite 103, Atlanta, GA 30326, and our telephone number is (844) 722-6333. Our corporate website address is www.alzamend.com. The information contained on or accessible through our website is not a part of this prospectus supplement.

| S-3 |

THE OFFERING

The following summary is provided solely for your convenience and is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus. For a more detailed description of our Common Stock, see “Description of Our Securities.”

The Series A Preferred

| Issuer: | Alzamend Neuro, Inc. |

| Series A Preferred Offered by us: | 50 shares of Series A Preferred. |

| Offering Price: | $10,000 per share of Series A Preferred. |

| Dividend Rate: | The Series A Preferred accrue dividends at a rate of 15% per annum, payable quarterly in arrears in cash or additional shares of Series A Preferred, in the Investor’s sole discretion. |

| Conversion Price: | Each share of Series A Preferred is convertible into such number of shares of Common Stock equal to the Stated Value divided by (y) the greater of (i) $0.25 per share and (ii) the lesser of (A) $1.50 and (B) 80% of the lowest closing price of our Common Stock during the three trading days immediately prior to the date of conversion into shares of Common Stock. The Conversion Price is subject to adjustment in the event of an issuance of Common Stock at a price per share lower than the Conversion Price then in effect, but not below the Floor Price. The Floor Price shall, however, be adjusted for stock dividends, stock splits, stock combinations or other similar transactions. |

| Ranking: | The Series A Preferred ranks senior to all existing and future equity capitalization. |

| Liquidation: | In the event of liquidation, dissolution, or winding up of our company, the holders of Series A Preferred have a preferential right to receive an amount equal to the Stated Value per share of Series A Preferred before any distribution to other classes of capital stock. |

| Voting Rights: | The holders of Series A Preferred are entitled to vote with the Common Stock as a single class on an “as-converted” basis, provided, however, that for purposes of complying with Nasdaq rules and regulations, the conversion price, for purposes of determining the number of votes the holder of Series A Preferred is entitled to cast, shall not be lower than $0.563. |

Share of Common Stock Issuable upon Conversion of the Series A Preferred

| Shares Issuable Upon Conversion: | Up to 1,375,310 shares of our Common Stock, subject to adjustment upon the split or combination of our Common Stock and certain similar events. |

| Shares of Common Stock to be Outstanding After this Offering:(1) | 8,255,304 shares of Common Stock (including shares issuable upon the conversion of the Series A Preferred and registered hereunder but excluding any shares of Common Stock issuable upon conversion of the Series A Preferred or exercise of the Warrants to be issued in the concurrent private placement). |

| Limitation on Beneficial Ownership: | A holder of the Series A Preferred will not have the right to convert any shares of Series A Preferred, and the Company will not effect any conversion of any shares of Series A Preferred, to the extent that after giving effect to such conversion, the holder would beneficially own in excess of 4.99% of the outstanding shares of our Common Stock calculated in accordance with Section 13(d) of the Exchange Act. However, any holder may increase or decrease such beneficial ownership limitation upon notice to us, provided that such limitation cannot exceed 9.99%, and provided that any increase in the beneficial ownership limitation shall not be effective until 61 days after such notice is delivered. |

| S-4 |

The number of shares of Common Stock that will be outstanding after this offering is based on 6,879,994 shares of Common Stock outstanding as of May 10, 2024, and excludes:

| ● | 2,40,4506 shares of Common Stock issuable upon exercise of outstanding warrants; | |

| ● | 2,100,000 shares of Common Stock issuable upon conversion of outstanding Series B convertible preferred stock; | |

| ● | 980,000 shares of Common Stock issuable upon exercise of outstanding stock options; | |

| ● | 2,500 shares of Common Stock issuable upon vesting outstanding restricted stock units; and | |

| ● | 620,000 shares of Common Stock reserved for future issuance under our stock incentive plans. |

General

| Use of Proceeds: | We will receive $500,000 from the Investor for purchase of the Series A Preferred registered hereunder. We agreed to pay Ault Lending, LLC, a related party, an origination fee of five percent (5%) of the total gross proceeds we receive from the Investor from the purchase of Series A Preferred. We will not receive any proceeds from the issuance of Conversion Shares upon conversion of the Series A Preferred. We currently expect to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds.” |

| Risk Factors: | Investing in the Series A Preferred or Common Stock involves a high degree of risk and uncertainty. You should read the “Risk Factors” section of this prospectus supplement and the accompanying prospectus, along with the information included under the same heading the documents incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of factors to consider before deciding to invest in the securities. |

| No Public Trading Market: | The Series A Preferred will be a new issue of securities for which there is no established market. Accordingly, there can be no assurance that a market for the Series A Preferred will develop or as to the liquidity of any market that may develop. |

| Nasdaq Capital Market Common Stock Symbol: | ALZN |

Purchase Agreement

| General: | We have entered into the Purchase Agreement with the Investor. The Purchase Agreement contains representations, warranties, covenants, termination provisions and indemnification provisions customary for transactions of this type. |

| Concurrent Private Placement of Series A Preferred and Warrants: | In a concurrent private placement, we are selling to the Investor in this offering, up to 2,450 Private Series A Preferred and the Warrants to purchase up to 20 million shares of our Common Stock. The Warrants will have an initial exercise price of $1.25 per share and will be immediately exercisable for a term of five years from issuance. The Private Series A Preferred, the shares of our Common Stock issuable upon conversion of the Private Series A Preferred, the Warrants and the shares of our Common Stock issuable upon exercise of the Warrants are not being registered under the Securities Act and are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus. There is no established public trading market for the Series A Preferred or the Warrants and we do not expect a market to develop. In addition, we do not intend to list the Series A Preferred or the Warrants on the Nasdaq Capital Market, any other national securities exchange or any other nationally recognized trading system. |

| S-5 |

RISK FACTORS

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described below and under the heading “Risk Factors” contained in our most recent Annual Report on Form 10-K for the period ended April 30, 2023 and Quarterly Report on Form 10-Q for the period ended January 31, 2024, which are incorporated by reference into this prospectus supplement and the accompanying prospectus in their entirety, together with the other information in this prospectus supplement and the accompanying prospectus and the documents incorporated by reference. The risks or uncertainties described in these documents are not the only ones we face, but those that we consider to be material as of the date hereof. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. You should not consider past financial performance to be a reliable indicator of future performance, nor should you rely on historical trends to anticipate results or trends in future periods. If any of these risks or uncertainties actually occurs, our business, financial condition, results of operations, or cash flow could be harmed and result in a loss of part or all of your investment. Please also read carefully the section below titled “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to This Offering

Our management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds, and the proceeds may not be invested successfully.

Our management will have broad discretion as to the use of the net proceeds from any offering by us and could use them for purposes other than those contemplated at the time of this offering. Accordingly, you will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that the proceeds will be invested in a way that does not yield a favorable, or any, return for us.

The Series A Preferred is convertible into our Common Stock at a discount to the market price, which would increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders.

The Series A Preferred is convertible into shares of our Common Stock at a conversion price equal to the greater of (i) $0.25 per share and (ii) the lesser of (A) $1.50 and (B) 80% of the lowest closing price of our Common Stock during the three trading days immediately prior to the date of conversion into shares of Common Stock. Based upon a closing price of $0.528 for our Common Stock during the three trading days prior to May 9, 2024, the 50 shares of Series A Preferred issued in this offering would be convertible, at a conversion price of $0.4224 into approximately 1,183,712 Conversion Shares. In the event that the price of our Common Stock should close at or below approximately $0.45 per share, because of the Nasdaq Limit, the Series A Preferred would be unable to be converted into more than 1,375,310 shares of our Common Stock, unless and until we obtain stockholder approval. As a result, the maximum number of Conversion Shares we may issue to the Investor under this prospectus supplement is 1,375,310. The shares of our Common Stock issued upon conversion of the Series A Preferred will result in dilution to the then existing holders of our Common Stock and increase the number of shares eligible for resale in the public market. Sales of substantial numbers of such shares in the public market could adversely affect the market price of our Common Stock.

The certificate of designation for the Series A Preferred contains anti-dilution provisions that may result in the reduction of the Conversion Price in the future. This feature may result in an increased number of shares of Common Stock being issued upon conversion of the Series A Preferred. Sales of these shares will dilute the interests of other security holders and may depress the price of our Common Stock and make it difficult for us to raise additional capital.

The certificate of designation for our Series A Preferred contains anti-dilution provisions, which provisions require the lowering of the applicable Conversion Price, as then in effect, to the purchase price of equity or equity-linked securities issued in subsequent offerings. If in the future, while any of our Series A Preferred is outstanding, we issue securities at an effective purchase price less than the applicable Conversion Price of our Series A Preferred, as then in effect, we will be required, subject to certain limitations and adjustments as provided in the certificate of designation for the Series A Preferred, to further reduce the Conversion Price, subject to a floor price of $0.25, which will result in a greater number of shares of Common Stock being issuable upon conversion of the Series A Preferred, which in turn will have a greater dilutive effect on our stockholders.

| S-6 |

The Series A Preferred provides for the payment of dividends in cash or in additional shares of our Series A Preferred, in the Investor’s option, which could require us to issue additional shares of Common Stock upon conversion of Series A Preferred issued as dividends.

Each share of the Series A Preferred is entitled to receive cumulative dividends at the rate per share of 15% per annum of the Stated Value per share. The dividends are payable, at the Investor’s discretion, in cash, out of any funds legally available for such purpose, or in pay-in-kind additional shares of Series A Preferred. In the event that the Investor elects to receive additional shares of Series A Preferred, that will increase the amount of dividends we are required to pay in the future, and increases the number of shares of Common Stock issuable upon conversion of the Series A Preferred. We will not be permitted to pay the dividend in cash unless we are legally permitted to do so under Delaware law. As such, if we are unable to pay cash, it is more likely that the Investor would elect to receive additional shares of Series A Preferred rather than accrue the receipt of the cash dividend payment, which will result in further dilution to our stockholders.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock at prices that may not be the same as the equivalent price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by any investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our Common Stock, or securities convertible or exchangeable into Common Stock, in future transactions may be higher or lower than the price per share paid by any investors in this offering.

Sales of a substantial number of our shares of Common Stock in the public markets, or the perception that such sales could occur, could cause our stock price to fall.

We may issue and sell additional shares of Common Stock in the public markets, including during this offering. As a result, a substantial number of our shares of Common Stock may be sold in the public market. Sales of a substantial number of our shares of Common Stock in the public markets, including in connection with this offering, or the perception that such sales could occur, could depress the market price of our Common Stock and impair our ability to raise capital through the sale of additional equity securities.

Because we do not currently intend to declare cash dividends on our shares of Common Stock in the foreseeable future, stockholders must rely on appreciation of the value of our Common Stock for any return on their investment.

We have never paid cash dividends on our Common Stock and do not plan to pay any cash dividends in the near future. We currently intend to retain all of our future earnings, if any, to finance the operation, development and growth of our business. Furthermore, any future debt agreements may also preclude us from paying or place restrictions on our ability to pay dividends. As a result, capital appreciation, if any, of our Common Stock will be your sole source of gain with respect to your investment for the foreseeable future.

There is no existing market for the Series A Preferred and we cannot assure that a market will develop.

There is no existing market for the Series A Preferred and we do not intend to apply for listing of the Series A Preferred on any securities exchange. We cannot assure that an active trading market for the Series A Preferred will develop. There can be no assurances as to the liquidity of any market that may develop for the Series A Preferred, the ability of a holder to sell their Series A Preferred or the price at which such holder may sell such Series A Preferred. Future trading prices of the Series A Preferred will depend on many factors, including, among other things, prevailing interest rates, our operating results and the market for similar securities. Generally, the liquidity of, and trading market for, the Series A Preferred may also be materially and adversely affected by declines in the market for similar securities. Such a decline may materially and adversely affect such liquidity and trading independent of our financial performance and prospects.

Risks Related to our Common Stock

We are not in compliance with the Nasdaq continued listing requirements. If we are unable to comply with the continued listing requirements of The Nasdaq Capital Market, our Common Stock could be delisted, which could affect our Common Stock’s market price and liquidity and reduce our ability to raise capital.

On September 26, 2023, we were notified by Nasdaq that for the previous 30 consecutive trading days, the minimum Market Value of Listed Securities (“MVLS”) for our Common Stock was below the $35 million minimum MVLS requirement for continued listing on Nasdaq under Nasdaq Listing Rule 5550(b)(2) (the “MVLS Rule”). In accordance with Listing Rule 5810(c)(3)(C), we were provided 180 calendar days, or until March 25, 2024, to regain compliance with the MVLS Rule.

On March 26, 2024, we were notified by Nasdaq that we had not regained compliance with the MVLS Rule. As a result, unless we requested an appeal of this determination, Nasdaq determined that our Common Stock would be scheduled for delisting from The Nasdaq Capital Market and would be suspended at the opening of business on April 4, 2024 and a Form 25-NSE would be filed with the SEC. On April 2, 2024, we requested a hearing before the Nasdaq Hearings Panel (the “Panel”) to appeal the determination. The Panel heard our appeal at a hearing on May 9, 2024. At the hearing, we believe we demonstrated our ability to regain compliance with the Nasdaq continued listing requirements, as well as our ability to sustain long-term compliance with all applicable maintenance criteria. The hearing request stayed the suspension of our common stock and the filing of the Form 25-NSE pending the Panel’s decision, and our Common Stock continues to trade on The Nasdaq Capital Market under the symbol “ALZN.” There can be no assurance as to the success or outcome of the appeal to the Panel.

| S-7 |

In addition, on February 1, 2024, we received a notice in the form of a letter from Nasdaq stating that we were not in compliance with Nasdaq Listing Rule 5550(a)(2) because the bid price for our Common Stock had closed below $1.00 per share for the previous 30 consecutive business days.

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we have 180 calendar days, or until July 30, 2024, to regain compliance with the Nasdaq Listing Rule 5550(a)(2). The deficiency letter states that to regain compliance, the bid price for our Common Stock must close at $1.00 per share or more for a minimum of 10 consecutive business days (the “Minimum Bid Price”) during the compliance period ending July 30, 2024. In the event that we do not regain compliance within this 180-day period, we may be eligible to seek an additional compliance period of 180 calendar days if we meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for The Nasdaq Capital Market, with the exception of the Minimum Bid Price, and provides written notice to Nasdaq of our intent to cure the deficiency during this second compliance period, by effecting a reverse stock split, if necessary. However, if it appears to the Nasdaq staff that we will not be able to cure the deficiency, or if we are otherwise not eligible, Nasdaq will provide us with notice that our Common Stock will be subject to delisting. At that time, we may appeal any such delisting determination to a Nasdaq hearings panel. The deficiency letter has no immediate effect on the listing of our Common Stock, and our Common Stock will continue to trade on The Nasdaq Capital Market under the symbol “ALZN.”

We intend to actively monitor the closing bid price of our Common Stock between now and July 30, 2024 and may, if appropriate, evaluate available options to resolve the deficiency and regain compliance with the Minimum Bid Price requirement. While we are exercising diligent efforts to maintain the listing of our Common Stock on Nasdaq, there can be no assurance that we will be able to regain compliance with the Minimum Bid Price or maintain compliance with the other Nasdaq listing standards.

If our Common Stock is delisted, it could be more difficult to buy or sell our Common Stock and to obtain accurate quotations, and the price of our Common Stock could suffer a material decline. Delisting could also impair the liquidity of our Common Stock and could harm our ability to raise capital through alternative financing sources on terms acceptable to us, or at all, and may result in potential loss of confidence by investors, employees, and fewer business development opportunities.

| S-8 |

USE OF PROCEEDS

We expect to receive gross proceeds from this offering of $500,000, which excludes the proceeds we will receive from the sale of additional shares of Private Series A Preferred in the Concurrent Private Placement and proceeds we may receive upon exercise of the warrants issued in the Concurrent Private Placement. We agreed to pay Ault Lending, LLC, a related party, an origination fee of five percent (5%) of the total gross proceeds we receive from the Investor from the purchase of Series A Preferred. We will not receive any proceeds from the issuance of Conversion Shares upon conversion of the Series A Preferred.

We will bear all of the expenses of this offering, and such expenses will be paid out of our general funds. We currently intend to use the net proceeds from this offering for working capital and general corporate purposes.

| S-9 |

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

The following description is a summary of some of the terms of our securities. The descriptions in this prospectus supplement and the accompanying prospectus of our securities and our organizational documents do not purport to be complete and are subject to, and qualified in their entirety by reference to, our organizational documents, copies of which have been or will be filed or incorporated by reference as exhibits to the registration statement of which this prospectus supplement and the accompanying prospectus form a part. This summary supplements the description of our capital stock in the accompanying prospectus and, to the extent it is inconsistent, replaces the description in the accompanying prospectus.

We are offering 50 shares of our Series A Preferred. We are also registering up to 1,375,310 shares of our Common Stock issuable from time to time upon conversion of the Series A Preferred offered hereby.

Series A Preferred

General

The following is a brief summary of certain terms and conditions of the Series A Preferred being offered by us. The following description is subject in all respects to the provisions contained in the Series A COD, the form of which will be filed as an exhibit to the Current Report on Form 8-K that we file upon the closing of this offering. Capitalized terms not otherwise defined in this description of Series A Preferred shall have the meanings ascribed to such terms in the Series A COD.

Dividends

Holders of the Series A Preferred will be entitled to receive dividends at the rate of 15% per annum, payable quarterly in arrears in cash or additional shares of Series A Preferred, in the Investor’s sole discretion.

Conversion

Each share of Series A Preferred is convertible into such number of shares of Common Stock equal to the Stated Value divided by (y) the greater of (i) $0.25 per share and (ii) the lesser of (A) $1.50 and (B) 80% of the lowest closing price of our Common Stock during the three trading days immediately prior to the date of conversion into shares of Common Stock. The Conversion Price is subject to adjustment in the event of an issuance of Common Stock at a price per share lower than the Conversion Price then in effect, but not below the Floor Price. The Floor Price shall, however, be adjusted for stock dividends, stock splits, stock combinations or other similar transactions.

Voting Rights

The holders of the Series A Preferred Stock are entitled to vote with the Common Stock as a single class on an as-converted basis, subject to applicable law provisions of the Delaware General Company Law and Nasdaq, provided however, that for purposes of complying with Nasdaq regulations, the conversion price, for purposes of determining the number of votes the holder of Series A Preferred is entitled to cast, shall not be lower than the Voting Floor Price, which represents the closing sale price of the Common Stock on the trading day immediately prior to the execution date of the Purchase Agreement. The Voting Floor Price shall be adjusted for stock dividends, stock splits, stock combinations and other similar transactions.

Exchange Cap

The Series A Preferred will not be convertible into shares of Common Stock in excess of the Nasdaq Limit, which is 19.99% of our shares of Common Stock issued and outstanding on the date of execution of the Purchase Agreement, except in the event that the Company obtains stockholder approval for issuances of shares of Common Stock in excess of the Nasdaq Limit. Until such approval, no holder of Series A Preferred shall be issued in the aggregate more shares of Common Stock than the Nasdaq Limit.

Beneficial Ownership Limitations

A holder of the Series A Preferred will not have the right to convert any shares of Series A Preferred, and the Company will not effect any conversion of any shares of Series A Preferred, to the extent that after giving effect to such conversion, the holder would beneficially own in excess of 4.99% of the outstanding shares of our Common Stock calculated in accordance with Section 13(d) of the Exchange Act. However, any holder may increase or decrease such beneficial ownership limitation upon notice to us, provided that such limitation cannot exceed 9.99%, and provided that any increase in the beneficial ownership limitation shall not be effective until 61 days after such notice is delivered.

| S-10 |

Exchange Listing

There is no established trading market for the Series A Preferred and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Series A Preferred on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Series A Preferred will be limited.

Liquidation

In the event of liquidation, dissolution, or winding up of the Company, the holders of Series A Preferred have a preferential right to receive an amount equal to the Stated Value per share of Series A Preferred before any distribution to other classes of capital stock. If the assets are insufficient, the distribution will be prorated among the holders of Series A Preferred. The Series A Preferred Stock rank senior over other classes of preferred stock, including the Series B convertible preferred stock. Additionally, any transaction that constitutes a Change of Control Event (as defined in the Series A COD) shall be deemed to be a liquidation under the Series A COD.

Common Stock

We are authorized to issue 300,000,000 shares of Common Stock, par value $0.001 per share. As of May 9, 2024, there were 6,879,994 shares of our Common Stock issued and outstanding. The outstanding shares of our Common Stock are validly issued, fully paid and nonassessable.

Holders of our shares of Common Stock are entitled to one vote for each share on all matters submitted to a shareholder vote. Holders of our Common Stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of our Common Stock voting for the election of directors can elect all of the directors. Holders of our Common Stock representing a majority of the voting power of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of shareholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our certificate of incorporation.

Holders of our Common Stock are entitled to share in all dividends that our Board of Directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over our Common Stock. Our Common Stock has no preemptive, subscription or conversion rights and there are no redemption provisions applicable to our Common Stock.

Shares Offered in this Prospectus Supplement

We are offering up to 1,375,310 shares of our Common Stock issuable upon conversion of the Series A Preferred.

Transfer Agent and Registrar

The Transfer Agent and Registrar for our common stock is Computershare, 8742 Lucent Blvd., Suite 225, Highlands Ranch, CO 80129.

| S-11 |

PRIVATE PLACEMENT TRANSACTION

In the Concurrent Private Placement pursuant to the Purchase Agreement, we are also selling to the Investor in this offering, up to 2,450 Private Series A Preferred and the Warrants to purchase up to 20 million shares of our Common Stock in several tranches, which Private Series A Preferred and the Warrants shall be unregistered. The Warrants will have an initial exercise price of $1.25 per share and will be immediately exercisable for a term of five years from issuance. The Private Series A Preferred, the shares of our Common Stock issuable upon conversion of the Private Series A Preferred, the Warrants and the shares of our Common Stock issuable upon exercise of the Warrants are not being registered under the Securities Act of 1933, as amended (the “Securities Act”), and are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus.

Private Series A Preferred

The Investor has agreed to purchase up to 2,450 shares of Private Series A Preferred. The terms of the Private Series A Preferred are the same as the Series A Preferred being sold pursuant to this prospectus supplement, as further described herein under the section “Description of the Securities we are Offering – Series A Preferred”.

Pursuant to the Purchase Agreement, the Investor shall purchase the Private Series A Preferred as follows:

| • | 50 shares, for $500,000, within five days of execution of the Purchase Agreement, which will close concurrently with the registered direct offering (the “First Tranche”); |

| • | 150 shares, for $1,500,000, upon filing of a resale registration statement (the “Registration Statement”); |

| • | 250 shares, for $2,500,000, within 30 days of the effectiveness of the Registration Statement; |

| • | 200 shares, for $2,000,000, within 60 days of the effectiveness of the Registration Statement and execution of a partnership agreement with a nationally renowned research facility for a clinical trial (the “Fourth Tranche”); and |

| • | 100 shares, for $1,000,000, on each monthly anniversary of the effectiveness of the Registration Statement until all 2,450 shares of Private Series A Preferred have been sold (each, a “Final Tranche”). |

In the event that the average closing price of the Common Stock during the prior three trading days preceding a closing date above shall not be equal to or greater than the Floor Price, then the applicable closing shall be delayed until such time as the price meets the required threshold.

At the First Tranche closing, a portion of the purchase price for that First Tranche will be paid by the Investor by the cancellation of the outstanding amount owed, including accrued but unpaid interest, on a term note in the principal face amount of $310,000 that we sold to the Investor on April 29, 2024 for a purchase price of $300,000. The Company has agreed to pay the Investor a fee of $100,000 upon each of the First Tranche, the Fourth Tranche and the third, eighth and thirteenth Final Tranche.

We agreed to use our best efforts to file the Registration Statement, registering for resale the shares of Common Stock issuable upon conversion of the Private Series A Preferred and exercise of the Warrants, with the SEC within 30 days of the execution date of the Purchase Agreement, and cause the Registration Statement to be declared effective within 90 days of the execution date of the Purchase Agreement. In the event that we fail to timely file the Registration Statement or it is not declared effective within the agreed upon timeframe, then we agreed to pay the Investor liquidated damages equal to 2% of the purchase price of the securities for such failure, and for every 30 day period thereafter, subject a maximum payment of liquidated damages of 10% of the purchase price.

In addition, we agreed to use our best efforts to hold a special meeting of our stockholders within 90 days of the execution date of the Purchase Agreement for purposes of seeking stockholder approval of the issuance of all the shares of Common Stock upon conversion of the Series A Preferred and the Private Series A Preferred and the exercise of the Warrants, in excess of the Nasdaq Limit.

The Purchase Agreement provides that the Investor shall, for as long as any shares of Series A Preferred remain outstanding, have the right to request, in the event we issue other securities to a different investor (the “Other Investor”) that have more favorable terms than are contained in the Purchase Agreement, the Series A COD and the Warrant, that it be granted the same preferential rights with which we provide the Other Investor.

Further, for a period of two years from execution of the Purchase Agreement (the “Obligation Period”), the Investor will have a right of first refusal to with respect to any investment proposed to be made by an Other Investor for each and every future public or private equity offering, including a debt instrument convertible into equity of our company during the Obligation Period.

| S-12 |

Moreover, during the Obligation Period and provided that at any such time the Investor shall hold no fewer than twenty-five (25) shares of Series A Preferred and has not elected to exercise its rights described immediately above, the Investor shall have a right to participate in any subsequent financing (a “Subsequent Financing”) allowing the Investor to purchase such number of securities in the Subsequent Financing to allow the Investor to maintain its percentage beneficial ownership in our company the Investor held immediately prior to the Subsequent Financing.

The Company agreed to pay Ault Lending, LLC, a related party, an origination fee of five percent (5%) of the total gross proceeds received by the Company from the Investor upon each purchase of Private Series A Preferred.

Warrants

The Investor shall receive Warrants to purchase a number of shares of our Common Stock equal to the quotient obtained by dividing the purchase price paid by the Investor for Series A Preferred and Private Series A Preferred at each tranche closing by 1.25. On the First Tranche, the Investor shall receive Warrants to purchase 800,000 shares of our Common Stock. Upon completion of all tranche closings, the Investor shall have received Warrants to purchase an aggregate of 20 million shares of our Common Stock.

Duration and Exercise Price

Each Warrant will be exercisable for one share of our Common Stock at an exercise price of $1.25 per share, will be exercisable immediately upon issuance and will have a term of five years from the date of issuance. The exercise price is subject to customary adjustments for stock dividends, stock splits, reclassifications and the like.

Exercisability

The Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our Common Stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s Warrants to the extent that the holder would own more than 4.99% (or 9.99%, at the holder’s election) of our outstanding Common Stock immediately after exercise, except that upon notice from the holder to us, the holder may decrease or increase the limitation of ownership of outstanding Common Stock after exercising the holder’s Warrants up to 9.99% of the number of shares of our Common Stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Warrants, provided that any increase in such limitation shall not be effective until 61 days following notice to us.

Cashless Exercise

If, at the time a holder exercises its Warrants, a registration statement registering the issuance of the shares of common stock underlying the Warrants under the Securities Act, is not then effective or available for the issuance of such shares, then in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of Common Stock determined according to a formula set forth in the Warrant.

Fractional Shares

No fractional shares of Common Stock will be issued upon the exercise of the Warrants. Rather, the number of shares of Common Stock to be issued will be rounded up to the nearest whole number.

Rights as a Shareholder

The holders of Warrants do not have the rights or privileges of holders of our Common Stock, including any voting rights, until such holders exercise their Warrants.

| S-13 |

PLAN OF DISTRIBUTION

Pursuant to this prospectus supplement and the accompanying prospectus, we are offering 50 shares of Series A Preferred at a public offering price of $10,000 per share of Series A Preferred. The securities are being offered directly to the Investor without a placement agent, underwriter, broker or dealer.

We have entered into the Purchase Agreement with the Investor for the full amount of the offering. The Purchase Agreement contains representations, warranties, covenants, termination provisions and indemnification provisions customary for transactions of this type. The Purchase Agreement will be filed as an exhibit to a Current Report on Form 8-K on the date of this prospectus supplement and will be incorporated by reference into this prospectus supplement. This summary of the material provisions of the Purchase Agreement does not purport to be a complete statement of its terms and conditions.

Our obligation to issue and sell the Series A Preferred to the Investor is subject to the conditions set forth in the Purchase Agreement. The Investor’s obligation to purchase the Series A Preferred is subject to conditions set forth in the Purchase Agreement as well. We expect that the sale of the Series A Preferred will be completed on or about May 10, 2024.

The transfer agent and registrar for our common stock is Computershare. The transfer agent and registrar’s address is 8742 Lucent Blvd., Suite 225, Highlands Ranch, CO 80129. Our common stock is listed on The Nasdaq Capital Market under the symbol “ALZN.”

We have agreed to indemnify the Investor in this offering against any and all losses, liabilities, obligations, claims, contingencies, damages, costs and expenses, including all judgments, amounts paid in settlements, court costs and reasonable attorneys’ fees and costs of investigation that any such indemnified party may suffer or incur as a result of or relating to any breach of any of the representations, warranties, covenants or agreements made by us in the Purchase Agreement; or any action instituted against an investor or its affiliates, by any of our stockholders who is not an affiliate of the investor or any governmental or regulatory agency, with respect to this offering (unless such action is based upon a material breach of such investor’s representations, warranties or covenants in the Purchase Agreement or any agreements or understandings such investor may have with any such stockholder or any material violations by the investor of state or federal securities laws or any conduct by such investor which constitutes fraud, gross negligence, willful misconduct or malfeasance) with respect to which, in each case, such investor has delivered a notice to us within one year from the date of this prospectus supplement. We have also agreed to pay certain legal fees and expenses incurred by the Investor in this offering.

| S-14 |

LEGAL MATTERS

The validity of the common stock offered by this prospectus is being passed upon for us by our counsel, Olshan Frome Wolosky LLP, New York, New York.

EXPERTS

The financial statements of Alzamend Neuro, Inc. as of April 30, 2023 and 2022 and for each of the two years in the period ended April 30, 2023 incorporated by reference in this prospectus supplement, the accompanying prospectus and registration statement from our Annual Report on Form 10-K for the years ended April 30, 2023 and 2022, have been audited by Baker Tilly US, LLP, an independent registered public accounting firm, as stated in their report thereon (which report expresses an unqualified opinion and includes an explanatory paragraph relating to the Company’s ability to continue as a going concern), incorporated herein by reference, and have been incorporated in this prospectus supplement, the accompanying prospectus and registration statement in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the Commission a registration statement on Form S-3 under the Securities Act, with respect to the securities covered by this prospectus. This prospectus and any prospectus supplement which form a part of the registration statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules filed therewith. For further information with respect to us and the securities covered by this prospectus, please see the registration statement and the exhibits filed with the registration statement. Any statements made in this prospectus or any prospectus supplement concerning legal documents are not necessarily complete and you should read the documents that are filed as exhibits to the registration statement or otherwise filed with the Commission for a more complete understanding of the document or matter. A copy of the registration statement and the exhibits filed with the registration statement may be inspected without charge at the Public Reference Room maintained by the Commission, located at 100 F Street, N.E., Washington, D.C. 20549. Please call the Commission at 1-800-SEC-0330 for more information about the operation of the Public Reference Room. The Commission also maintains an internet website that contains reports, proxy and information statements and other information regarding registrants that file electronically with the Commission. The address of the website is http://www.sec.gov.

We file annual, quarterly and current reports, proxy statements and other information with the Commission. You may read, without charge, and copy the documents we file at the Commission’s public reference room in Washington, D.C. at 100 F Street, N.E., Washington, D.C. 20549. You can request copies of these documents by writing to the Commission and paying a fee for the copying cost. Please call the Commission at 1-800-SEC-0330 for further information on the public reference rooms. Our filings with the Commission are available to the public at no cost from the SEC’s website at http://www.sec.gov.

The reports and other information filed by us with the Commission are also available at our website, www.ault.com. Information contained on our website or that can be accessed through our website is not incorporated by reference into this prospectus or any prospectus supplement and should not be considered to be part of this prospectus or any prospectus supplement.

| S-15 |

INCORPORATION OF DOCUMENTS BY REFERENCE

We have filed a registration statement on Form S-3 with the Commission under the Securities Act. This prospectus is part of the registration statement but the registration statement includes and incorporates by reference additional information and exhibits. The Commission permits us to “incorporate by reference” the information contained in documents we file with the Commission, which means that we can disclose important information to you by referring you to those documents rather than by including them in this prospectus. Information that is incorporated by reference is considered to be part of this prospectus and you should read it with the same care that you read this prospectus. Information that we file later with the Commission will automatically update and supersede the information that is either contained, or incorporated by reference, in this prospectus, and will be considered to be a part of this prospectus from the date those documents are filed. We have filed with the Commission, and incorporate by reference in this prospectus:

| • | Our Annual Report on Form 10-K for the period ended April 30, 2023, filed with the Commission on July 27, 2023; |

| • | Our Quarterly Reports on Form 10-Q for the periods ended July 31, 2023, October 31, 2023 and January 31, 2024, filed with the SEC on September 13, 2023, December 15, 2023 and March 25, 2024, respectively; |

| • | Our Current Reports on Form 8-K filed on August 7, 2023, August 16, 2023, September 8, 2023, September 29, 2023, October 30, 2023 (Item 5.03 only), January 5, 2024, February 2, 2024, March 7, 2024, March 22, 2024, March 29, 2024, April 30, 2024, May 1, 2024, May 7, 2024 (Item 1.02 only) and May 9, 2024 (two Current Reports on Form 8-K filed); and |

| • | The description of our common stock contained in our registration statement on Form S-3 filed with the SEC on August 2, 2023. |

We also incorporate by reference all additional documents that we file with the Securities and Exchange Commission under the terms of Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act that are made after the initial filing date of the registration statement of which this prospectus is a part until the offering of the particular securities covered by a prospectus supplement or term sheet has been completed. We are not, however, incorporating, in each case, any documents or information that we are deemed to furnish and not file in accordance with Commission rules, including any information furnished under either Item 2.02 or Item 7.01 of any Current Report on Form 8-K.

We will provide you, without charge upon written or oral request, a copy of any and all of the information that has been incorporated by reference in this prospectus and that has not been delivered with this prospectus. Requests should be directed to Alzamend Neuro, Inc., 3480 Peachtree Road NE, Second Floor, Suite 103, Atlanta, GA 30326; Tel.: (844) 722-6333; Attention: Mr. Stephan Jackman, Chief Executive Officer.

| S-16 |

$25,000,000

Common Stock

Preferred Stock

Warrants

Rights

Units

We may offer and sell, from time to time in one or more offerings, any combination of common stock, preferred stock, warrants, rights or units having an aggregate initial offering price not exceeding $25,000,000. The preferred stock, warrants, rights and units may be convertible, exercisable or exchangeable for common stock or preferred stock or other securities of ours.

Each time we sell a particular class or series of securities, we will provide specific terms of the securities offered in a supplement to this prospectus. The prospectus supplement may also add, update or change information in this prospectus. You should read this prospectus and any prospectus supplement, as well as the documents incorporated by reference or deemed to be incorporated by reference into this prospectus, carefully before you invest in any securities.

This prospectus may not be used to offer or sell our securities unless accompanied by a prospectus supplement relating to the offered securities.

Our common stock is presently listed on the Nasdaq Capital Market under the symbol “ALZN.” On July 31, 2023, the last reported sale price of our common stock was $0.453.